Broken Promises, Broken Dreams

Posted on October 22, 2012 by Neil Garfield

Editor’s Comment: This story is all too common. But it is complete too, which is why I am publishing it. Practically every line is contains material for bank liability. Nobody wants to say it: the banks were wrong when they pretended to issue mortgages with the money of pensioners and retirement accounts, they were wrong when they traded on the loans as if they were their own, and they were wrong for dumping the losses on investors and homeowners.By Andrea Egizi, newjunkiepost.com

For millions of Americans, owning a home is the grandest symbol of accomplishment into the illusion of the “American Dream”. In the United states, we have been indoctrinated to believe being a homeowner signifies success, financial stability and responsibility.

My former husband and I had been renters a few years before the thought ever crossed our minds to look into the prospect of home-ownership. Mostly out of curiosity, we decided to meet with a mortgage lender to see what qualifications (if any) we had and see what the whole lending process entailed.

We set up an appointment with a small local mortgage lender who was sly and charming and offered us a loan right off the bat; seeing that we were both employed and our credit checks came up with decent scores.

We were so disillusioned and eager to have a home of our own for ourselves and our two small children that we short-shortsightedly signed onto a mortgage that was affordable, but still a heavy financial burden. Not convinced by the lender to take on a sub-prime 80/20 loan, interest only or a no-doc loan; (as was originally presented when we first applied and has been the main focus on the burst of the ensuing housing bubble) a conventional Fanny Mae/Freddie Mac loan was readily available with 0 percent down. We completed all the paperwork and the transaction took place in June of 2008, only a few months before the begging of the housing market crash.

Not even a month had passed since we moved in when we received notification via mail from our local mortgage lender that the loan was being sold to a different company called Franklin American. Shortly after that, we received another notice that our mortgage was being sold yet again to Countrywide Financial, which subsequently was bought out by Bank Of America a very short time later. Then the city In New Jersey we moved to sent a letter stating there will be new a tax assessment of all the homes in the area. The result of the new appraisal blindsided us: our home was devalued by 65,000. We were now considered an underwater loan by 124 percent.

Our marriage fell apart soon after for mostly personal reasons (the recession played a major role as well) and the balance of the loan was placed solely on my shoulders. I was relieved to hear that President Obama had signed a new bill to help homeowners like me called the “Making Homes Affordable Program” a.k.a. HAMP, and that it was geared specifically to help struggling underwater homeowners stay in their homes by coming to an agreement on a loan reduction between the lending bank and the homeowner. Seeing as my hours at work were reduced due to economic downturn, and I had lost an entire half of our family income due to impending divorce, I considered this program as a godsend.

I had wasted no time in researching all the details and according to the guidelines, not only did I match all the criteria, but I seemed to be the perfect candidate for it. It was a relief I would be able to keep the roof over my children’s head, eliminating the ongoing fear of escalating debt and homelessness.

First came the initial phone call; which included a very emotional breakdown between myself and the Bank Of America customer service representative. The call delved into my personal life so deeply; I had to start from the beginning and explain to her every detail of my finances and my failed marriage. The customer representative was very understanding and helpful and guided me through the process of applying to the program and the paperwork to fill out arrived within a few days.

I had to provide the Bank Of America with a complete financial summary (calculated by an outside non-profit company Money Management International) in such vivid detail; even down to how much I spent a month to feed my dog, fill my car with gas, and clothe my children. Next was the tax returns, copies of my paychecks and partial-unemployment checks, and finally the “hardship letter” that was advised to me to be a hand-written letter explaining the financial burden that I had fallen into. The good news was, Bank of America agreed to let me pay $400 less a month while they reviewed my application thus relieving my finances to allow me to stay afloat.

All the tasks that were asked of me were completed and faxed over in a timely manner. Nine months plus went by, every payment made on time and in full at the reduced price, and no word on my application. I routinely called Bank of America to check up on my status, but all they ever told me was that they are very glad I am showing interest in my modification and that they would note on my file that I am an active participant in my case. A few times they requested duplicate papers that I had already sent in, but just as a precaution asked for them again and I had it faxed to them the next day if not sooner.

The response letter from Bank Of America arrived like a package and I even had to sign for it. I read each word slow and clear, careful not to misinterpret, and then I saw it, shocked like a confident student who just failed an exam: DENIED. The letter stated that I was denied entry in to program due to incomplete paperwork on my side and I had to now pay back all the money they were gracing me for the past nine months, equivalent to about $4,000.

I immediately made a phone call and asked every question I could to see exactly why I was denied. I demanded to speak with the supervisor and when I finally reached him (after about an hour) he kept repeating that they did not receive the necessary paperwork from me. I frantically debated him over this matter and the only result of the conversation was me filing for an appeal. I asked if I could pay the reduced price during the appeals process and he advised me that that was not an option. He also explained to me that if I did not pay back the graced $4,000, they would report to the credit companies that I am behind on mortgage payments and unless remedied, foreclosure proceedings would begin.

The word echoed in my head over and over… foreclosure. Foreclosure meant my kids would be without a home. Foreclosure meant I would have ruined credit. Foreclosure meant I would have to start all over again. Foreclosure meant that I failed.

I started doing heavy research into other homeowner denials by the mega “too big to fail banks”(with the short list of recipients consisting of Bank Of America, Wells Fargo, Citigroup, and J.P. Morgan Chase) and TARP (Troubles Assets Relief Program).

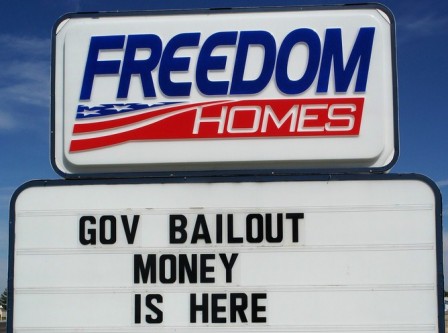

TARP is the program signed in by President Obama in 2008 that gave $700 billion to the leading mortgage lending banks with the most loans in default. According to the president, only “responsible borrowers” should be allowed to receive HAMP modifications which excludes owners of multiple and muti-million dollar homes and extreme debt-ridden families. The government then gave the banks the power of the final decisions of who, in fact, will receive a modification on their loan with government funded cash via taxpayers.

The biggest problem with TARP was indeed the fact that the greedy mega-banks were in charge of helping homeowners and were left unregulated to do so. The result of such careless oversight was that as of May 2012, 4.3 million people had applied for aid, but only one million had received any help from government sponsored program such as HAMP. Also, it is reported that over four million families have lost their homes to foreclosure since the beginning of 2007 to now; with the hardest hit areas being Nevada (Las Vegas being the leader with 1 in 9 homes in foreclosure and Reno with 1 in 16), Florida (with eleven major cities in the top 25 worst cities to be hit with foreclosure), California (eight major cities listed in the top 25), Arizona and Idaho.

Whistle blower complaints have been filed over Bank Of America stating that “The bank and its agents routinely pretended to have lost homeowners’ documents, failed to credit payments during trial modifications and intentionally misled homeowners about their eligibility for the program”. Many Americans were being denied for the very same reason I was denied. Also, in 2009, Bank of America was caught bullying eligible homeowners of HAMP into their own private and more expensive modification programs, which is a violation of the terms for HAMP.

With all of this data in my back-pocket, I made the decision to not give Bank of America another dime until they accept me into the HAMP program. I waited patiently while my loan went into default and in the meantime the bank sent their photographers out to take shots of my home to see if it was still occupied and maintained. I questioned a man I caught taking photos, and on him was my entire case history. The man was a third party hire, not working directly for Bank of America but for a local construction company. Next were the annoying phone calls that began trying to scare me into making payments that drove me to remove my land-line.

Four months later, Bank of America had results on my appeal: DENIED. The reason this time was that I failed to meet the financial qualifications. Very ironic to be denied entry into a program that was supposed to help struggling homeowners that were hit by economic difficulties.

I made yet another phone call to the bank, this time demanding to know what I can do to stay in my home. Since I am a waitress by trade, they said if I claim more tips on my tax return I could put myself into a higher tax bracket and therefore make the cut off for the program, whether or not I actually made that money. Also, they said I should take on a roommate or offer someone to live in my home and help me pay my mortgage. Fraudulent advice?

Another option they offered was short sale. With this type of transaction, the homeowner must stop making payments and fall behind (this fact did not bother me considering I was already behind in payments). The short sale process can be long, painful and subject to the whim of the bank and the buyers. Many people I have spoken to about short sale told me they were in the selling process, only to be denied for one crazy reason or another right before closing.

The bank also tried to convince me into Deed in Lieu of Foreclosure, meaning I just hand over the house and deed and walk away, but the major problem with that would be, I would still have bad credit and nowhere to live.

I was about to give up, sign on for a short sale or Deed in Lieu and move out, when I stumbled across an article from Zerohedge that led me to a campaign for homeowners that are demanding they see their original mortgage note to prove the bank does/does not hold onto it and therefore may/may not be able to foreclose .

This was something I never heard of before since my war with the bank began, and considering my mortgage was sold three times, I could be a potential victim of fraud. I sent an email to Bank Of America, as provided by the Zerohedge article, demanding to see my note and they did respond in the twenty days they are required by law to do so. I received in response to my inquiry a copy of my mortgage note via mail which was not what I was asking for. I myself have a copy of my mortgage note and I requested to see the original wet-ink note that they should have on their files. I offered to meet a courier within a hundred miles from my home just to prove to me they have it and their answer was that they were not required by law to show me the note, even if I asked for it. I have every right to see my bank note with my signature on it, especially in these circumstances so I sent them another email request to see my note and was denied yet again. This sort of dodging behavior was leading me to believe that Bank of America didn’t have possession of my note and therefore may not have any legal possession of my home.

It was right about this time that I had a final bomb drop: I listened to a report on National Pubic Radio (NPR) that banks can come back and sue short sale/foreclosure victims for the default money owed even many years after the cases are closed if there is a financial asset the bank can sue for. So now not only are Americans facing the nightmare of foreclosure, but we even have to face the fact that they could possibly sue us after-the-fact as well.

So the question I raise is, why are we letting this happen to us and why didn’t the Obama administration do more to help? Many critics have come out to say that the unregulated flow of cash that the mega-banks received to help troubled homeowners and the fact that these banks have not been using the funds as was suggested, was the greatest mistake the Obama administration has made to date. Officials in the administration have said in response that they did what they could with the way the banking and mortgage industry is set up and due to opposition, could not do more.

So what can defaulted homeowners do to stay in their homes and fight off the bank’s constant harassment? First, stay calm. Second, stay in your home. Third, do NOT send the bank any money. Fourth, contact (in writing) your mortgage lender to see your original wet ink mortgage note. More than likely they will deny your right to see it and that is okay; that is the first step that they are admitting they probably don’t have possession of it.

Fifth, if the bank does not agree to let you see the note then sit tight and wait for the sheriff to serve you formal foreclosure papers (and don’t worry, this is not the Old West so don’t be afraid to answer your door. You are not the criminal here, the bank is). And also know, before the sheriff arrives, you technically are not “in” foreclosure but what the banks are calling “pre-foreclosure”.

Sixth, do some research. The internet is the best way to find out all the updates and information on your state’s foreclosure proceedings. I know that here in New Jersey, the sheriff sale of a home is an average of 900 days after the sheriff serves foreclosure papers; which leaves plenty of time to see a lawyer or talk to an advocacy group about your ordeal and be offered some resources you may be able to use.

Seventh, if you have a lawyer in your area who will give you a free consultation, do it. Most likely if you are in foreclosure you cannot afford a lawyer, but at least you might get some legal advice for free on what your next step could be. Foreclosure advocacy groups are popping up all over the country in response to the housing market and bailout scams as well. When searching for an advocacy group in your area, always look for one that is non-profit; most likely ending in .org and not .com. Also look into your states squatter’s rights, especially if you have children.

One thing to keep in mind, this is war between the big banking cartel and you. It all might seem like a frightening place to stand, but you really do have more power than you think. Knowledge is truly power and the most you can do is arm yourself with the know-how to fight back. The reality is, unfortunately, you might lose. A new law could very well pass to force defaulted homeowners out of their homes, but in the meantime live your life as normally as possible; enjoy your children, savor your favorite meal, dance around at a concert, laugh at your high school yearbook picture and have in your back pocket a viable plan B, C, and D just in case you may need it.

Editor’s Note: Andrea Egizi is a journalist who focuses mainly on the the issues of ethics, equality and human rights. She is currently working on a novel. She is a seasoned front line activist and regular contributor to Raging Chicken Press. You can find Andrea on Facebook and Twitter. Photographs one, two, four, five, seven, eight and nine by Steve Rhodes. Photographs three and six by Alex E. Proimos.

No comments:

Post a Comment