Wednesday, March 27, 2013

Saturday, March 23, 2013

ChaseMeNails Homemade Nail Polish.

http://www.madnoodle.com/store/products/25-chase-me-nails-gift-card/

(Just copy and paste link...seriously, you can't beat this deal with a stick!)

Yup, my marketing team have lost their minds... $7.50 for a $25 gift certificate HOLY COW!!

(Just copy and paste link...seriously, you can't beat this deal with a stick!)

Yup, my marketing team have lost their minds... $7.50 for a $25 gift certificate HOLY COW!!

Thursday, March 21, 2013

Jamie Dimon Agrees with Occupy Wall Street: 'Too Much Inequality'

Jamie Dimon Agrees With Occupy Wall Street: 'Too Much Inequality'

by Eamon Murphy, Mar 20th 2013 6:00PM

According to Chris Otts of The Courier-Journal, Dimon told his audience that the United States has "too much inequality." This isn't a novel insight -- the Occupy Wall Street protests were predicated on this idea, expressed through the slogan "we are the 99 percent" -- but it's striking to hear it coming from Wall Street's most outspoken defender of financial elites.

"It doesn't mean we blame the successful," Dimon continued, sounding more characteristic, "but it's true. You want to have problems in society? Have inequality." Dimon mentioned "struggling inner-city public schools" in particular, Otts reports.

The statements represent a slight rhetorical softening for Dimon, who has in the past rejected the anti-banker sentiment that arose after the financial crisis of 2008. "Acting like everyone who's been successful is bad and because you're rich you're bad, I don't understand it," he said in late 2011 at an investors' conference in New York. Since then, a lot has changed for JPMorgan: the bank, seen as the most successful of the financial behemoths during the crisis, was recently the subject of a "riveting and devastating" Senate panel report that accused Dimon and other executives of hiding trading losses from investors and regulators.

According to The New York Times, a criminal investigation of this affair -- known popularly, after the trader who caused the losses, as "the London Whale" -- is "at an advanced stage."

Over at AlterNet, Lynn Stuart Parramore traces "The Spectacular Rise and Fall of Jamie Dimon, Wall Street's Golden Boy," presenting his life story as "a critique of the American Dream." Dimon, she argues, was singularly concerned with pursuing wealth, although in his early days as JPM CEO he "was widely perceived as a smart and cautious leader, shrewdly avoiding many of the fancy financial engineering tricks that were all the rage on Wall Street." And a society that has long viewed material flourishing as a sign of God's favor -- perhaps in some secularized form, more recently -- embraced the "success" Dimon so often touts, along with his self-professed prudence (embodied by his favorite catchphrase, "fortress balance sheet"), as a sign of goodness. President Barack Obama, for instance, held up JPMorgan and its leader as exemplars of American finance: "there are a lot of banks that are actually pretty well managed," the president said in Feb. 2009, explaining why his administration did not seek to replace executives at bailed-out firms, "JPMorgan being a good example. Jamie Dimon, the CEO there, I don't think should be punished for doing a pretty good job managing an enormous portfolio." (That balance sheet, incidentally, is by now almost one-ninth the size of the U.S. economy.)

Those days of public favor are over. Particularly damning is a report by Johsua Rosner, a longtime chronicler of Wall Street malfeasance, succinctly entitled "JPMorgan Chase: Out of Control." The blog Naked Capitalism called it "astonishing"; as one reads the report, writer David Dayen averred, "it's hard to see the bank as anything but a criminal racket just days away form imploding, were it not propped up by implicit bailout guarantees and light-touch regulators."

All of this might have been on Dimon's mind when he gave Tuesday's keynote, adopting a tone more in line with the concerns of ordinary Americans, while not exactly abandoning his defensive stance regarding "success". What Dimon has yet to do, at least publicly, is acknowledge the connection between anger at the banks and dismay at the consequences of inequality: namely, that public subsidy of financial institutions -- which, according to Bloomberg, consumes about three cents of every tax dollar collected -- diverts resources that might otherwise be applied toward socially useful ends. For instance, funding those struggling inner-city schools.

*****************************************************************************

I would love to but in my opinion here, but I digress, I'm sitting here waiting for Chase to get back to me...so I'm a bit pre-occupied to throw up right now.

Executive Summary JPM Out Of Control

http://www.scribd.com/doc/130290952/Gf-Co-Executive-Summary-JPM-Out-of-Control

The most interesting read to date.

The most interesting read to date.

Tuesday, March 19, 2013

Creative Outlet for a Very Long Week Waiting for JPM. #Inspire #Create #NailPolish #NonToxic

Monday, March 18, 2013

Saturday, March 16, 2013

Husband, wife found dead in Chesterfield. Murder-Suicide caused by Foreclosure.

Husband, wife found dead in Chesterfield murder-suicide

Police: It appears husband shot wife, set fires, then shot himself

Posted: Saturday, March 16, 2013 12:00 am

|

Updated: 12:07 am, Sat Mar 16, 2013.

BY JOE MACENKA AND MARK BOWES

Richmond Times-Dispatch

Richmond Times-Dispatch

A husband and wife who police said were having marital problems

were found fatally shot inside their burning home late Thursday as the

apparent result of a murder-suicide.

The bodies of the couple, identified as Walter M. Hester Jr., 50, and his wife, Clara M. Morgan-Hester, 46, were discovered on different floors of their two-story house after firefighters responded to a fire inside at 11:30 p.m., police said.

Investigators said evidence suggests Hester shot his wife and set several fires in the residence before turning the handgun on himself. Family members told police that one of the two had discussed leaving the other, and police said they believe that prompted the events leading to the shootings and fire.

Police said they could find no documented history of domestic violence at the family’s home, which is in the 2000 block of Castle Glen Court, just off Providence Road West and a short distance north of Rockwood Park.

Chesterfield police Lt. Randy Horowitz said the weapon used was a handgun that police believe was Hester’s. The couple had a teenage son who was not home at the time of the shootings and is now staying with relatives, Horowitz said.

The family had lived at the cul-de-sac home since purchasing it in 2004, county real estate records show.

But it went into foreclosure Oct. 25, according to listings on Richmond BizSense.com.

Hester was self-employed doing landscaping and yard work; Morgan-Hester worked for an area bank, Horowitz said.

Chesterfield firefighters were called to respond to reports of a house fire late Thursday, and the first units on the scene found smoke and fire coming from the structure. The blaze was brought under control in 20-25 minutes, said Lt. Jason Elmore with Chesterfield Fire & EMS.

“The fire was in several areas of the house. It wasn’t contained to one area,” said Elmore, who added that the areas where fire was found were not adjoining.

Elmore said the bulk of the fire was just inside the front door, although investigators were continuing their attempts to establish the point of the fire’s origin.

“We don’t have a specific area of origin right now,” Elmore said early Friday morning. “It’s possible there could be multiple origins.”

After the fire was brought under control, firefighters were able to begin an interior search of the house, and they found the two bodies.

“I believe one was on the first floor and one was on the second,” he said.

As investigators worked at the scene, broken windows were visible on the first and second floors, and there was fire debris and torn vinyl siding outside the residence, including a pile just outside the front door.

Yellow police tape surrounded the home, which is in a neighborhood of well-maintained colonials and Cape Cods.

Several neighbors said they were stunned by the deaths of the Hesters, whom they described as a fairly typical married couple.

“They were very quiet,” said Lara Leyendecker. “I never heard them arguing. They kept their yard nice and their house nice.”

“This is just really … ” she said, her voice trailing off. “What can you say?”

jmackena@timesdispatch.com

(804) 649-6331

mbowes@timesdispatch.com

(804) 649-6450

Staff writer Reed Williams

contributed to this report.

The bodies of the couple, identified as Walter M. Hester Jr., 50, and his wife, Clara M. Morgan-Hester, 46, were discovered on different floors of their two-story house after firefighters responded to a fire inside at 11:30 p.m., police said.

Investigators said evidence suggests Hester shot his wife and set several fires in the residence before turning the handgun on himself. Family members told police that one of the two had discussed leaving the other, and police said they believe that prompted the events leading to the shootings and fire.

Police said they could find no documented history of domestic violence at the family’s home, which is in the 2000 block of Castle Glen Court, just off Providence Road West and a short distance north of Rockwood Park.

Chesterfield police Lt. Randy Horowitz said the weapon used was a handgun that police believe was Hester’s. The couple had a teenage son who was not home at the time of the shootings and is now staying with relatives, Horowitz said.

The family had lived at the cul-de-sac home since purchasing it in 2004, county real estate records show.

But it went into foreclosure Oct. 25, according to listings on Richmond BizSense.com.

Hester was self-employed doing landscaping and yard work; Morgan-Hester worked for an area bank, Horowitz said.

Chesterfield firefighters were called to respond to reports of a house fire late Thursday, and the first units on the scene found smoke and fire coming from the structure. The blaze was brought under control in 20-25 minutes, said Lt. Jason Elmore with Chesterfield Fire & EMS.

“The fire was in several areas of the house. It wasn’t contained to one area,” said Elmore, who added that the areas where fire was found were not adjoining.

Elmore said the bulk of the fire was just inside the front door, although investigators were continuing their attempts to establish the point of the fire’s origin.

“We don’t have a specific area of origin right now,” Elmore said early Friday morning. “It’s possible there could be multiple origins.”

After the fire was brought under control, firefighters were able to begin an interior search of the house, and they found the two bodies.

“I believe one was on the first floor and one was on the second,” he said.

As investigators worked at the scene, broken windows were visible on the first and second floors, and there was fire debris and torn vinyl siding outside the residence, including a pile just outside the front door.

Yellow police tape surrounded the home, which is in a neighborhood of well-maintained colonials and Cape Cods.

Several neighbors said they were stunned by the deaths of the Hesters, whom they described as a fairly typical married couple.

“They were very quiet,” said Lara Leyendecker. “I never heard them arguing. They kept their yard nice and their house nice.”

“This is just really … ” she said, her voice trailing off. “What can you say?”

jmackena@timesdispatch.com

(804) 649-6331

mbowes@timesdispatch.com

(804) 649-6450

Staff writer Reed Williams

contributed to this report.

Thursday, March 14, 2013

Wells Fargo CEO confronted over Foreclosure Policies.

Wells Fargo CEO Meets a Desperate Homeowner Facing Foreclosure, Flees

by Doug Porter on March 14, 2013 · 0 comments

Wells

Fargo Bank CEO John Stumpf’s keynote speech to the American Banker

Retail Lending Conference on Thursday morning didn’t quite work out like

he (or anyone else) expected. Midway through his address, single mom

Betty Badro calmly walked up on the stage to confront him over Wells

Fargo’s foreclosure polices.

Wells

Fargo Bank CEO John Stumpf’s keynote speech to the American Banker

Retail Lending Conference on Thursday morning didn’t quite work out like

he (or anyone else) expected. Midway through his address, single mom

Betty Badro calmly walked up on the stage to confront him over Wells

Fargo’s foreclosure polices.Ms. Badro, who has worked for the State of California for 22 years, attempted to deliver a personal check to the CEO, and tried to explain that she was hoping to forestall a scheduled foreclosure of her home tomorrow, March 15th. Not saying another word, Mr. Stumpf turned his back on Ms. Badro and left the stage.

After months of trying to get Wells Fargo to consider a loan modification, Ms. Badro explained she felt that going to the top man was the only way she could protect the lives of her disabled brother and one of her two children.

She got into trouble with the bank after suffering financial setbacks due to state furloughs and personal health issues. Her finances have now recovered, a HUD-certified housing counselor has reviewed her case, and believes that Ms. Badro qualifies for a loan modification.

After the Wells Fargo CEO left the stage at the luxurious Park Hyatt Aviara Resort, Badro was joined by fifty members of the Alliance of Californians for Community Empowerment (ACCE), the Home Defenders League, and Occupy Fights Foreclosures. The group attempted to explain to those in attendance how Wells Fargo has failed the community and the changes that Wells Fargo should make in their foreclosure practices. The audience followed Stumpf’s lead, packing up and leaving.

Thursday’s event was part of a broader campaign of ACCE and the Home Defenders League to push Wells Fargo to change their practices in order to reduce foreclosures. The groups are calling on Wells Fargo to:

• Make principal reduction a core front-end strategy when considering loan modifications;

• Release data on race & income of the homeowners they foreclose on, evict or assist.

• Stop all foreclosures and evictions stop until these steps are put into place.

On Tuesday ACCE released California in Crisis: How Wells Fargo’s Foreclosure Pipeline Is Damaging Local Communities,

a report documenting the bank’s failure to negotiate in good faith with

financially distressed home owners facing losing their homes.There’s a happy ending to this story. Betty Badro was notified this afternoon that her foreclosure has been postponed indefinitely.

******************************************************************************

So, this got me thinking....Where is Jamie Dimon, cause I would LOVE to speak with him. <3 you

Not so Breaking News: New Report Exposes JPMorgan Chase as a Mostly a Criminal Enterprise

Thursday, March 14, 2013

David Dayen: Out of Control – New Report Exposes JPMorgan Chase as Mostly a Criminal Enterprise

By David Dayen, a lapsed blogger, now a freelance writer based in Los Angeles, CA. Follow him on Twitter @ddayen

There’s been an unlikely yet welcome resurgence of chatter about breaking up the nation’s largest and most powerful banks. Bloomberg’s story quantifying the too big to fail subsidy grabbed some eyeballs (and there’s an upcoming GAO report on the subsidy that will do the same). Sherrod Brown announced an unlikely pairing with David Vitter working on legislation on the subject. Dallas Fed President Richard Fisher is going to give a big speech on Friday on breaking up the banks… at CPAC, the largest conservative political conference of the year.

At the same time the unending stream of reports of abuses and fraudulent actions give fuel to the movement. And we’ll get another one Friday, when Carl Levin’s Senate Permanent Subcommittee on Investigations releases their report, complete with a companion hearing, on the London “Fail Whale” trades, the losses for which stretch as high as $8 billion. Early reports suggest that the report will be unsparing. Levin’s committee did an excellent job in prior investigations of Wall Street, including Goldman Sachs (which they gift-wrapped to the Justice Department as a criminal referral, only to see DoJ toss it in the wastebasket). People I’ve talked to expect the hearing to be explosive.

As an excellent preview for the Friday fireworks, I urge you to read an astonishing new report, which I’ve embedded below, from analyst Josh Rosner of Graham-Fisher and Co. The best way to describe the report, “JPM – Out of Control,” is that it reads like a rap sheet. Notably, Rosner takes mortgage abuses almost entirely out of the equation, and yet still manages to fill a 45-page report with documented case after documented case of serious fraud and abuse, most of which JPM has already admitted to (at least in the sense of reaching a settlement; given out captured regulatory structure the end result is invariably a settlement with the “neither admit nor deny wrongdoing” boilerplate appended). Rosner writes, “we could not find another ‘systemically important’ domestic bank that has recently been subject to as many public, non-mortgage related, regulatory actions or consent orders.”

Obviously this contrasts with Jamie Dimon’s spotless reputation (at least in Washington) and his bold talk of a “fortress balance sheet.” Yet as you read the report, it’s hard to see the bank as anything but a criminal racket just days away from imploding, were it not propped up by implicit bailout guarantees and light-touch regulators. Rosner paints a picture of a corporation saddled with pervasive internal control problems, which end up costing shareholders, and which “could materially impact profitability in the future.” He calculates that since 2009, JPM has paid out $8.5 billion in settlements for its outlaw activity, which equals nearly 12% of net income over the same period.

It’s hard to summarize all of the documented instances in this report of JPM has been breaking the law, but here’s my best shot. I try to keep up on these matters, and yet some of these I’m learning about for the first time:

Bank Secrecy Act violations;

Money laundering for drug cartels;

Violations of sanction orders against Cuba, Iran, Sudan, and former Liberian strongman Charles Taylor;

Violations related to the Vatican Bank scandal (get on this, Pope Francis!);

Violations of the Commodities Exchange Act;

Failure to segregate customer funds (including one CFTC case where the bank failed to segregate $725 million of its own money from a $9.6 billion account) in the US and UK;

Knowingly executing fictitious trades where the customer, with full knowledge of the bank, was on both sides of the deal;

Various SEC enforcement actions for misrepresentations of CDOs and mortgage-backed securities;

The AG settlement on foreclosure fraud;

The OCC settlement on foreclosure fraud;

Violations of the Servicemembers Civil Relief Act;

Illegal flood insurance commissions;

Fraudulent sale of unregistered securities;

Auto-finance ripoffs;

Illegal increases of overdraft penalties;

Violations of federal ERISA laws as well as those of the state of New York;

Municipal bond market manipulations and acts of bid-rigging, including violations of the Sherman Anti-Trust Act;

Filing of unverified affidavits for credit card debt collections (“as a result of internal control failures that sound eerily similar to the industry’s mortgage servicing failures and foreclosure abuses”);

Energy market manipulation that triggered FERC lawsuits;

“Artificial market making” at Japanese affiliates;

Shifting trading losses on a currency trade to a customer account;

Fraudulent sales of derivatives to the city of Milan, Italy;

Obstruction of justice (including refusing the release of documents in the Bernie Madoff case as well as the case of Peregrine Financial).

And, exhale.

The sheer litany of illegal activities just overwhelms you. And these are only the ones where the company has entered into settlements or been sanctioned; it doesn’t even include ongoing investigations into things like Libor, illegally concealing inclusions of mortgage-backed securities in employer funds (another ERISA violation), the Fail Whale trades, and especially putback suits for mortgages, where a recent ruling by Judge Jed Rakoff has seriously increased exposure. While the risks are still very much alive and will continue to weigh on the firm, ultimately shareholders will pay, certainly not executives as long as the no-prosecutions standard holds.

Again, read the report, but two case studies stand out. First, JPM is trying to stick the public with losses related to its purchase of Washington Mutual and its related liabilities. Rosner documents painstakingly how JPM originally accepted the risks and responsibilities with the WaMu deal, and continued to do so for several years. But now that they see the actual possibility of mass mortgage-related putback claims, JPM wants to shift losses on over $190 billion in MBS onto the FDIC. They hope to get out from under as much as $5 billion in losses in this fashion. It’s impossible to logically follow JPM’s claim that they purchased WaMu but not any of its risk-related activities. The case “demonstrates the unwillingness to accept responsibility for their own management failures,” Rosner writes.

Finally, we have the Fail Whale trade, the subject of the Friday Permanent Subcommittee on Investigations hearing. Rosner keys in on JPM’s internal “Task Force” report, which he compellingly characterizes as a complete whitewash. The Task Force was led by the heir apparent to the company, Michael Cavanagh (“like asking Joe Paterno to do the Penn State investigation instead of Louis Freeh,” in the words of former SEC chair Harvey Pitt). It limited the scope of the investigation to late 2011 and 2012, when now-public data clearly shows the problems at the Chief Investment Office going back years earlier, and fully known to senior management at the time. Rosner correctly brings up Sarbox Title III violations in conjunction with this, as top executives annually attested to the accuracy of financial statements now known to be untrue. The Task Force tried to exonerate Jamie Dimon by actually saying in a footnote that he was out of town for a period of time covered by the report.

And this footnote from the Task Force takes the cake:

Rosner has compiled an impressive dossier for any systemic risk regulator, if we had such things in more than name only in America. And I trust this will be a contribution to the ongoing debate – there really is one – over whether these mega-banks have become too big to manage, and too corrupt to continue.

There’s been an unlikely yet welcome resurgence of chatter about breaking up the nation’s largest and most powerful banks. Bloomberg’s story quantifying the too big to fail subsidy grabbed some eyeballs (and there’s an upcoming GAO report on the subsidy that will do the same). Sherrod Brown announced an unlikely pairing with David Vitter working on legislation on the subject. Dallas Fed President Richard Fisher is going to give a big speech on Friday on breaking up the banks… at CPAC, the largest conservative political conference of the year.

At the same time the unending stream of reports of abuses and fraudulent actions give fuel to the movement. And we’ll get another one Friday, when Carl Levin’s Senate Permanent Subcommittee on Investigations releases their report, complete with a companion hearing, on the London “Fail Whale” trades, the losses for which stretch as high as $8 billion. Early reports suggest that the report will be unsparing. Levin’s committee did an excellent job in prior investigations of Wall Street, including Goldman Sachs (which they gift-wrapped to the Justice Department as a criminal referral, only to see DoJ toss it in the wastebasket). People I’ve talked to expect the hearing to be explosive.

As an excellent preview for the Friday fireworks, I urge you to read an astonishing new report, which I’ve embedded below, from analyst Josh Rosner of Graham-Fisher and Co. The best way to describe the report, “JPM – Out of Control,” is that it reads like a rap sheet. Notably, Rosner takes mortgage abuses almost entirely out of the equation, and yet still manages to fill a 45-page report with documented case after documented case of serious fraud and abuse, most of which JPM has already admitted to (at least in the sense of reaching a settlement; given out captured regulatory structure the end result is invariably a settlement with the “neither admit nor deny wrongdoing” boilerplate appended). Rosner writes, “we could not find another ‘systemically important’ domestic bank that has recently been subject to as many public, non-mortgage related, regulatory actions or consent orders.”

Obviously this contrasts with Jamie Dimon’s spotless reputation (at least in Washington) and his bold talk of a “fortress balance sheet.” Yet as you read the report, it’s hard to see the bank as anything but a criminal racket just days away from imploding, were it not propped up by implicit bailout guarantees and light-touch regulators. Rosner paints a picture of a corporation saddled with pervasive internal control problems, which end up costing shareholders, and which “could materially impact profitability in the future.” He calculates that since 2009, JPM has paid out $8.5 billion in settlements for its outlaw activity, which equals nearly 12% of net income over the same period.

It’s hard to summarize all of the documented instances in this report of JPM has been breaking the law, but here’s my best shot. I try to keep up on these matters, and yet some of these I’m learning about for the first time:

Bank Secrecy Act violations;

Money laundering for drug cartels;

Violations of sanction orders against Cuba, Iran, Sudan, and former Liberian strongman Charles Taylor;

Violations related to the Vatican Bank scandal (get on this, Pope Francis!);

Violations of the Commodities Exchange Act;

Failure to segregate customer funds (including one CFTC case where the bank failed to segregate $725 million of its own money from a $9.6 billion account) in the US and UK;

Knowingly executing fictitious trades where the customer, with full knowledge of the bank, was on both sides of the deal;

Various SEC enforcement actions for misrepresentations of CDOs and mortgage-backed securities;

The AG settlement on foreclosure fraud;

The OCC settlement on foreclosure fraud;

Violations of the Servicemembers Civil Relief Act;

Illegal flood insurance commissions;

Fraudulent sale of unregistered securities;

Auto-finance ripoffs;

Illegal increases of overdraft penalties;

Violations of federal ERISA laws as well as those of the state of New York;

Municipal bond market manipulations and acts of bid-rigging, including violations of the Sherman Anti-Trust Act;

Filing of unverified affidavits for credit card debt collections (“as a result of internal control failures that sound eerily similar to the industry’s mortgage servicing failures and foreclosure abuses”);

Energy market manipulation that triggered FERC lawsuits;

“Artificial market making” at Japanese affiliates;

Shifting trading losses on a currency trade to a customer account;

Fraudulent sales of derivatives to the city of Milan, Italy;

Obstruction of justice (including refusing the release of documents in the Bernie Madoff case as well as the case of Peregrine Financial).

And, exhale.

The sheer litany of illegal activities just overwhelms you. And these are only the ones where the company has entered into settlements or been sanctioned; it doesn’t even include ongoing investigations into things like Libor, illegally concealing inclusions of mortgage-backed securities in employer funds (another ERISA violation), the Fail Whale trades, and especially putback suits for mortgages, where a recent ruling by Judge Jed Rakoff has seriously increased exposure. While the risks are still very much alive and will continue to weigh on the firm, ultimately shareholders will pay, certainly not executives as long as the no-prosecutions standard holds.

Again, read the report, but two case studies stand out. First, JPM is trying to stick the public with losses related to its purchase of Washington Mutual and its related liabilities. Rosner documents painstakingly how JPM originally accepted the risks and responsibilities with the WaMu deal, and continued to do so for several years. But now that they see the actual possibility of mass mortgage-related putback claims, JPM wants to shift losses on over $190 billion in MBS onto the FDIC. They hope to get out from under as much as $5 billion in losses in this fashion. It’s impossible to logically follow JPM’s claim that they purchased WaMu but not any of its risk-related activities. The case “demonstrates the unwillingness to accept responsibility for their own management failures,” Rosner writes.

Finally, we have the Fail Whale trade, the subject of the Friday Permanent Subcommittee on Investigations hearing. Rosner keys in on JPM’s internal “Task Force” report, which he compellingly characterizes as a complete whitewash. The Task Force was led by the heir apparent to the company, Michael Cavanagh (“like asking Joe Paterno to do the Penn State investigation instead of Louis Freeh,” in the words of former SEC chair Harvey Pitt). It limited the scope of the investigation to late 2011 and 2012, when now-public data clearly shows the problems at the Chief Investment Office going back years earlier, and fully known to senior management at the time. Rosner correctly brings up Sarbox Title III violations in conjunction with this, as top executives annually attested to the accuracy of financial statements now known to be untrue. The Task Force tried to exonerate Jamie Dimon by actually saying in a footnote that he was out of town for a period of time covered by the report.

And this footnote from the Task Force takes the cake:

The description of “what happened” is not a technical analysis of the Synthetic Credit Portfolio or the price movements in the instruments held in the Synthetic Credit Portfolio. Instead, it focuses on the trading decision-making process and actions taken (or not taken) by various JPMorgan personnel. The description of activities described in this Report (including the trading strategies) is based in significant measure on the recollections of the traders (and in particular the trader who had day-to-day responsibility for the Synthetic Credit Portfolio and was the primary architect of the trades in question) and others. The Task Force has not been able to independently verify all of these recollections.Hey, who knows, don’t believe anything we’re saying, it’s not an investigation so much as an impressionistic collage.

Rosner has compiled an impressive dossier for any systemic risk regulator, if we had such things in more than name only in America. And I trust this will be a contribution to the ongoing debate – there really is one – over whether these mega-banks have become too big to manage, and too corrupt to continue.

****************************************************************************

So, when dealing with the brain damage of a JPMorgan Chase, what is a girl to do? I was debating on hanging from the rafters...but thought this might be a little more proactive....and healthier choice.

Lord knows dealing with them has toxified my life to an extent that I cannot put into words, the emotional duress is un real. So this was and is my answer:

http:/www.chasemenails.com and there is a "special" line inspired directly by this egregious, horrifying disaster that won't stop. "The Bank Collection"

PS Still LOVE you, even though you continue to lie to me. I will however not back down.

-Michelle

Wednesday, March 13, 2013

Fraud, Robo-signing and Suicides. All in days work.

Thursday, August 23, 2012

Mark Ames: Tracy Lawrence: The Foreclosure Suicide America Forgot

By Mark Ames, the author of Going Postal: Rage, Murder and Rebellion from Reagan’s Workplaces to Clinton’s Columbine.Cross posted from The eXiled

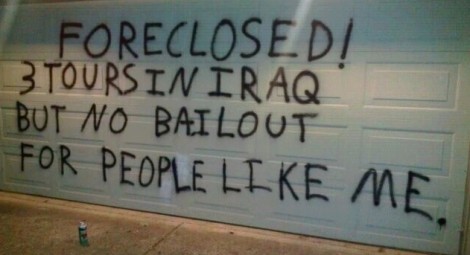

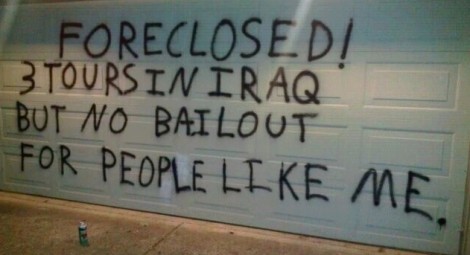

Before the 2008 crisis, the media paid little attention to the death toll taken on Americans by the decades-long class warfare waged against the 99%. Now they’re impossible to ignore. Stories like the US soldier in Iraq who committed suicide so that his wife could collect life insurance, and save their family home from foreclosure. Or the courtroom-suicide in Phoenix, in which a Yale-educated banker-swindler swallowed a cyanide capsule after being found guilty of setting his 10,000 sq foot McMansion on fire as a way of collecting insurance and evading mortgage payments he couldn’t afford.

Despite the somewhat increased media attention given to these tragic stories nowadays, there is one suicide directly tied to foreclosure fraud that has been completely ignored by the media. Her name was Tracy Lawrence, and for a brief moment last year, between the moment she turned whistleblower and her untimely and bizarre suicide, Tracy Lawrence’s testimony threatened to blow the entire fraud-closure criminal enterprise wide open, with repercussions that could have easily reverberated all the way up to the major banks and GSEs complicit in one of the greatest crimes this country has ever experienced.

In the months since Tracy Lawrence was found dead in her Las Vegas apartment at the age of 43, her story has only taken on more significance—even as her death has been forgotten. This is a story that demands our attention, a story we must not allow ourselves to forget.

First, some background to Tracy Lawrence’s suicide: On November 16, 2011, the attorney general for the state of Nevada, Catherine Cortez Masto, announced a major first-of-its-kind 606-count criminal indictment against two Orange County, California-based title officers working for Lender Processing Services, the country’s largest mortgaging servicing company and the worst of the predatory “fraudclosure mills.”

Foreclosure fraud had been devastating America unabated for a few years, laying waste to untold hundreds of thousands of American families. The Nevada attorney general’s criminal case against the two LPS title officers—Gary Trafford and Geraldine Sheppard—represented, for a brief moment, the first time in years that American justice threatened the predatory lending class.

The next day, the Los Angeles Times reported on the scale of the fraud:

Just a few months after the Nevada AG’s 606-count criminal indictment against LPS, Missouri’s attorney general filed a 136-count criminal indictment against a unit of Lender Processing Services, called Docx, as the New York Times reported last February. That meant two major criminal cases.

Given the sheer scale of the crime committed—a plundering so brutal and devastating you’d only expect such a thing from a conquering barbarian horde—what amazes me is how underreported this crime still is, and how few Americans in the Establishment know any of the details, beyond perhaps the word “robo-signing.”

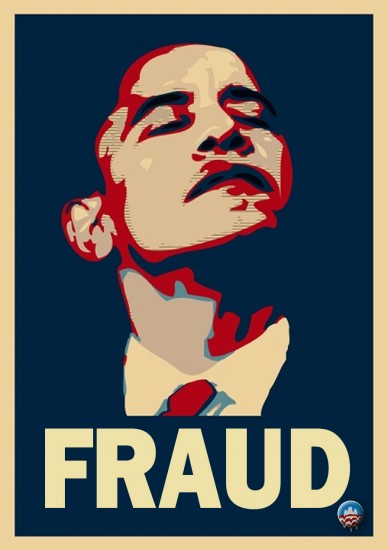

One of the rare exceptions was the excellent reporting done on my friend Dylan Ratigan’s Show, as well as the unforgettable 60 Minutes segment aired last year on foreclosure fraud and “robo-signing” mills. The 60 Minutes investigation focused on the fraud perpetrated by Lender Processing Services unit, Docx, which used blatantly fraudulent “robo-signing” foreclosure documents to dispossess Americans of their homes on behalf of the Wall Street banks. Like the way peasants in a banana republic are treated, hundreds of thousands—if not millions— of Americans have been illegally and fraudulently evicted from their homes. And all the while as it happened, the Obama Administration stood by and wrung its hands—and that’s the kind, whitewashed way of putting it. Another way of looking at what the Obama Administration did with the mass foreclosure fraud crime—the true and honest way of putting it—is that the White House actively provided political and legal cover for one of the largest crimes perpetrated against Americans in modern history. Sorry, but that’s the truth—and the sad thing is, as horrible as the Obama Administration has been on housing, a President Romney will almost certainly find a way to be even worse, even if that worseness has to be invented. That’s one of the lessons we’ve all had to learn these past few decades.

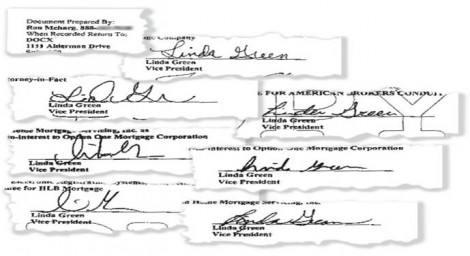

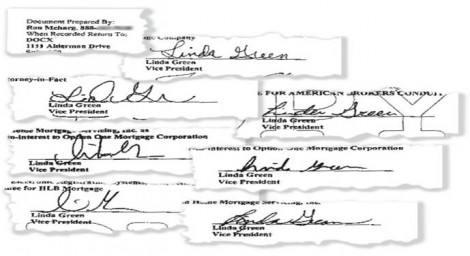

Among the worst of the foreclosure servicers abusing the fraudulent “Linda Green” signature was Docx, the unit of Lender Processing Services which has since been shuttered.

60 Minutes tracked down the real “Linda Green” whose name was fraudulently abused to destroy the lives of countless Americans, and it’s worth quoting what 60 Minutes found:

In return for turning state’s witness, Tracy Lawrence plea bargained her charges down to a single misdemeanor charge of falsely notarizing a signature, which carries, in the worst case scenario, a maximum of one year in prison and a $2,000 fine. However, her testimony could put her two LPS superiors behind bars for decades—which is why many believed Nevada’s goal was to turn those two LPS officers into state’s witnesses against LPS’s senior executives.

On November 29, 2011—just two weeks after the Nevada attorney general announced the landmark criminal case—whistleblower Tracy Lawrence was supposed to appear before a judge for her sentencing. It should have been a routine appearance, but she didn’t show up. Her lawyer grew anxious, called police to check on Tracy Lawrence’s home, and that’s when they found her dead.

The timing of her death was suspicious, to say the least. Immediately, before any investigation had been conducted, Las Vegas police officially “ruled out homicide” as her cause of death.

Tracy Lawrence’s suicide was given scant coverage in the national media. Here is one of the few national media stories about her death, a short piece on MSNBC’s website:

Though there has been little public discussion about Tracy Lawrence’s suicide, in private forums, her death sent a chill. Although there have been reports that Lawrence was depressed and stressed from her role as the key whistleblower, no one I know who reports on the housing disaster unquestioningly accepts the official version, that Tracy Lawrence’s suicide timing just happened to come at the most convenient time imaginable.

The stakes could not have been higher: As MSNBC reported, Las Vegas police said that her testimony threatened to “throw into question the legality of most Las Vegas home foreclosures in the past few years.”

As one commenter darkly quipped on the site 4closurefraud.org:

It took over two decades for authorities to overturn the “suicide” verdict and state the obvious: In 2003, Italian authorities ruled Roberto Calvi’s death a murder.

In the meantime, the fallout from Tracy Lawrence’s suicide has been worse than predictable: In Nevada, the case against Lender Processing Services appears to have all but fallen apart. With the Obama Administration foisting its foreclosure fraud settlement on all the states in January—a deal that left bankers happy, and everyone else screwed— and the key witness to the LPS case dead, the writing was on the wall.

Masto essentially fired her deputy AG, John Kelleher, who headed up the once-aggressive Nevada mortgage Fraud Task Force. With Kelleher gone, the Task Force looks like its work is all but over, as reported in local Las Vegas Channel 8 News:

Along with Kelleher, several other Nevada prosecutors and investigators have since been reassigned or transferred out to pasture. In the courts, a Nevada judge all but gutted the AG’s criminal case against Lender Processing Servicers.

Over in Missouri, the state’s criminal case was recently quietly settled for a paltry sum, and forgotten about.

Meanwhile in LPS’s headquarter state of Florida, the attorney general Pam Bondi has done everything to protect LPS, even firing two of her office’s attorneys who made the mistake of investigating LPS fraud.

All we can for now—while this country is still controlled by a rank oligarchy— is remember Tracy Lawrence’s suicide, so that some day we can learn what drove this hero to her terrifying early grave.

This article was first published in the Daily Banter

Every week, it seems there’s another tragic story about a suicide or murder-suicides linked to foreclosure trauma. Some of the more spectacular murder-by-foreclosure stories the past few years have been collected by a blog called “Greenspan’s Body Count”—others, myself included,

have been writing about these terrible stories of class warfare being

waged by the only side fighting it, and winning it, as Warren Buffett

rightly said.Before the 2008 crisis, the media paid little attention to the death toll taken on Americans by the decades-long class warfare waged against the 99%. Now they’re impossible to ignore. Stories like the US soldier in Iraq who committed suicide so that his wife could collect life insurance, and save their family home from foreclosure. Or the courtroom-suicide in Phoenix, in which a Yale-educated banker-swindler swallowed a cyanide capsule after being found guilty of setting his 10,000 sq foot McMansion on fire as a way of collecting insurance and evading mortgage payments he couldn’t afford.

Despite the somewhat increased media attention given to these tragic stories nowadays, there is one suicide directly tied to foreclosure fraud that has been completely ignored by the media. Her name was Tracy Lawrence, and for a brief moment last year, between the moment she turned whistleblower and her untimely and bizarre suicide, Tracy Lawrence’s testimony threatened to blow the entire fraud-closure criminal enterprise wide open, with repercussions that could have easily reverberated all the way up to the major banks and GSEs complicit in one of the greatest crimes this country has ever experienced.

In the months since Tracy Lawrence was found dead in her Las Vegas apartment at the age of 43, her story has only taken on more significance—even as her death has been forgotten. This is a story that demands our attention, a story we must not allow ourselves to forget.

First, some background to Tracy Lawrence’s suicide: On November 16, 2011, the attorney general for the state of Nevada, Catherine Cortez Masto, announced a major first-of-its-kind 606-count criminal indictment against two Orange County, California-based title officers working for Lender Processing Services, the country’s largest mortgaging servicing company and the worst of the predatory “fraudclosure mills.”

Foreclosure fraud had been devastating America unabated for a few years, laying waste to untold hundreds of thousands of American families. The Nevada attorney general’s criminal case against the two LPS title officers—Gary Trafford and Geraldine Sheppard—represented, for a brief moment, the first time in years that American justice threatened the predatory lending class.

What happened to the bombshell indictment of these LPS supervisors?

Yves Smith at Naked Capitalism was among the first to report the Nevada AG’s indictments, rightly pointing out the significance of going after mid-level officers in the foreclosure mill firm as a way of launching a full-scale takedown:“[A]s mob prosecutions have shown again and again, you start by going after the foot soldiers in the hope that they roll people higher up on the food chain. And at a minimum, this action says that the law and due process matter, and violations, particularly large scale, systematic violations, can and will be punished.”This marked the first time that bigtime bank fraudsters faced serious jail time—Attorney General Masto’s criminal case sent shockwaves throughout the mortgage lending world. More importantly, her criminal case threatened to finally change the way America deals with the bankster class that has been plundering with impunity for years. Politically, Nevada’s criminal indictment could have enormous repercussions; economically, the case could lead to invalidating tens upon tens of thousands of fraudulent foreclosures conducted in the Las Vegas area over the past few years.

The next day, the Los Angeles Times reported on the scale of the fraud:

In what appear to be the first criminal charges to stem from the fracas over improper foreclosures last year, two Southern California title loan officers have been indicted by a Nevada grand jury for allegedly filing tens of thousands of improper documents related to Las Vegas-area foreclosures.

The Clark County grand jury charged Gary Trafford, 49, of Irvine and Geraldine Sheppard, 62, of Santa Ana on 606 counts, alleging that the two headed up a vast “robo-signing” operation that resulted in the filing of tens of thousands of fraudulent foreclosure documents.

The documents were filed with the Clark County recorder’s office between 2005 and 2008, according to the indictment. The two title loan officers worked for the firm Lender Processing Services, a foreclosure processing company based in Florida that has been used by most of the largest banks in the nation to process home repossessions.”

Just a few months after the Nevada AG’s 606-count criminal indictment against LPS, Missouri’s attorney general filed a 136-count criminal indictment against a unit of Lender Processing Services, called Docx, as the New York Times reported last February. That meant two major criminal cases.

Given the sheer scale of the crime committed—a plundering so brutal and devastating you’d only expect such a thing from a conquering barbarian horde—what amazes me is how underreported this crime still is, and how few Americans in the Establishment know any of the details, beyond perhaps the word “robo-signing.”

One of the rare exceptions was the excellent reporting done on my friend Dylan Ratigan’s Show, as well as the unforgettable 60 Minutes segment aired last year on foreclosure fraud and “robo-signing” mills. The 60 Minutes investigation focused on the fraud perpetrated by Lender Processing Services unit, Docx, which used blatantly fraudulent “robo-signing” foreclosure documents to dispossess Americans of their homes on behalf of the Wall Street banks. Like the way peasants in a banana republic are treated, hundreds of thousands—if not millions— of Americans have been illegally and fraudulently evicted from their homes. And all the while as it happened, the Obama Administration stood by and wrung its hands—and that’s the kind, whitewashed way of putting it. Another way of looking at what the Obama Administration did with the mass foreclosure fraud crime—the true and honest way of putting it—is that the White House actively provided political and legal cover for one of the largest crimes perpetrated against Americans in modern history. Sorry, but that’s the truth—and the sad thing is, as horrible as the Obama Administration has been on housing, a President Romney will almost certainly find a way to be even worse, even if that worseness has to be invented. That’s one of the lessons we’ve all had to learn these past few decades.

“Obama Lied, Hope Died” should be the slogan

The 60 Minutes segment zeroed in on what is now the most

infamous fraudulent-signature of our time: The infamous “Linda

Green”—whose signature appeared on an impossibly large number of foreclosure documents. A single fake “Linda Green” was officially listed as a “vice president” at some 20 different foreclosure mills, this same “Linda Green” signing untold thousands of fraudulent documents evicting Americans from their homes.Among the worst of the foreclosure servicers abusing the fraudulent “Linda Green” signature was Docx, the unit of Lender Processing Services which has since been shuttered.

60 Minutes tracked down the real “Linda Green” whose name was fraudulently abused to destroy the lives of countless Americans, and it’s worth quoting what 60 Minutes found:

We went searching for “the” Linda Green and found her in rural Georgia. She told us she has never been a bank vice president.So you have now a sense of just how vast the foreclosure fraud crime was, and how it involved not only the largest mortgage servicer in the nation, LPS, but also all the major banks that used LPS’s services to throw Americans out of their homes illegally and take possession of them.

In 2003, she was a shipping clerk for auto parts when her grandson told her about a job at a company called Docx. The company, that was once housed in Alpharetta, Ga., was a sweatshop for forged mortgage documents.

Docx, and companies like it, were recreating missing mortgage assignments for the banks and providing the legally required signatures of bank vice presidents and notaries. Linda Green says she was named a bank vice president by Docx because her name was short and easy to spell. As demand exploded, Docx needed more Linda Greens.

“So you’re Linda Green?” Pelley asked Chris Pendley.

“Yeah, can’t you tell?” Pendley, who is a man, replied.

Pendley worked at Docx at the same time and signed as Linda Green.

No fraud here folks, looks like 1 authentic “Linda Green” to us!

Let’s rewind again to last November 16, 2011, the day that Nevada’s

attorney general Masto announced her indictment against the two LPS

title officers—two weeks before Tracy Lawrence took her life. Nevada’s

case against LPS rested primarily on the testimony of a whistleblower,

Tracy Lawrence, who worked in Lender Processing Services’ office in Las

Vegas. Her testimony threatened to unravel tens of thousands of

fraudulent foreclosures in the state of Nevada between the years

2005-2008, and the criminal activities of the entire mortgage servicing

industry. Nevada has suffered the worst foreclosure problem of any state

in the union.In return for turning state’s witness, Tracy Lawrence plea bargained her charges down to a single misdemeanor charge of falsely notarizing a signature, which carries, in the worst case scenario, a maximum of one year in prison and a $2,000 fine. However, her testimony could put her two LPS superiors behind bars for decades—which is why many believed Nevada’s goal was to turn those two LPS officers into state’s witnesses against LPS’s senior executives.

On November 29, 2011—just two weeks after the Nevada attorney general announced the landmark criminal case—whistleblower Tracy Lawrence was supposed to appear before a judge for her sentencing. It should have been a routine appearance, but she didn’t show up. Her lawyer grew anxious, called police to check on Tracy Lawrence’s home, and that’s when they found her dead.

The timing of her death was suspicious, to say the least. Immediately, before any investigation had been conducted, Las Vegas police officially “ruled out homicide” as her cause of death.

Tracy Lawrence’s suicide was given scant coverage in the national media. Here is one of the few national media stories about her death, a short piece on MSNBC’s website:

Foreclosure fraud whistleblower found deadI recently called the Clark County coroner’s office to find out if they had determined her official cause of death. A spokesperson told me that Tracy died from “intoxication” of a combination of Xanax (Alprazolam) and two antihistamines: Benadryl (Diphenhydramine) and Hydroxyzine. Officially, her death was ruled a suicide.

By msnbc.com staff

A notary public who signed tens of thousands of false documents in a massive foreclosure scam before blowing the whistle on the scandal has been found dead in her Las Vegas home.

NBC station KSNV of Las Vegas reported that the woman, Tracy Lawrence, 43, was scheduled to be sentenced Monday morning after she pleaded guilty this month to notarizing the signature of an individual not in her presence. She failed to show up for her hearing, and police found her body at her home later in the day.

It could not immediately be determined whether Lawrence, who faced up to one year in jail and a fine of up to $2,000, died of suicide or of natural causes, KSNV reported. Detectives said they had ruled out homicide. [So quickly! And we thought only Russian police solved "crimeless" death scenes within minutes of arriving!—M.A.]

Lawrence came forward earlier this month and blew the whistle on the operation, in which title officers Gary Trafford, 49, of Irvine, Calif., and Geraldine Sheppard, 62, of Santa Ana, Calif. — who worked for a Florida processing company used by most major banks to process repossessions — allegedly forged signatures on tens of thousands of default notices from 2005 to 2008.

Police said at the time that the alleged scam had thrown into question the legality of most Las Vegas home foreclosures in the past few years, leaving many people living in foreclosed-upon homes that they unknowingly don’t actually own. [Good thing there's no motive to make a detective suspicious here or anything!—M.A.]

Though there has been little public discussion about Tracy Lawrence’s suicide, in private forums, her death sent a chill. Although there have been reports that Lawrence was depressed and stressed from her role as the key whistleblower, no one I know who reports on the housing disaster unquestioningly accepts the official version, that Tracy Lawrence’s suicide timing just happened to come at the most convenient time imaginable.

The stakes could not have been higher: As MSNBC reported, Las Vegas police said that her testimony threatened to “throw into question the legality of most Las Vegas home foreclosures in the past few years.”

As one commenter darkly quipped on the site 4closurefraud.org:

I bet Linda Green signs the coroners report….One only has to remember that Las Vegas’ gambling industry was created by mobsters like Meyer Lansky—who is also credited with helping invent modern offshore banking in the early 1930s in Switzerland. In this world, deaths ruled “suicides” are not unheard of. One of the most spectacular examples involved the “suicide” of Roberto Calvi, chairman of Italy’s largest private bank, who in 1982 was found hanging from London’s Blackfriars Bridge with bricks stuffed into his pockets along with $15,000 cash. The day before Calvi’s “suicide” his secretary “jumped” out of the bank headquarter’s fourth floor window and died—her death was also ruled suicide.

But seriously,

Now people can’t question the validity of the documents she attested to authentic because she is dead.

When they are alive you can challenge the presumption of authenticity. It’s nearly impossible to succeed if you can’t get the notary on the stand and cross examine them. Now there are 25000 properties that are pretty much a lock to be legitimized.

It took over two decades for authorities to overturn the “suicide” verdict and state the obvious: In 2003, Italian authorities ruled Roberto Calvi’s death a murder.

In the meantime, the fallout from Tracy Lawrence’s suicide has been worse than predictable: In Nevada, the case against Lender Processing Services appears to have all but fallen apart. With the Obama Administration foisting its foreclosure fraud settlement on all the states in January—a deal that left bankers happy, and everyone else screwed— and the key witness to the LPS case dead, the writing was on the wall.

Masto essentially fired her deputy AG, John Kelleher, who headed up the once-aggressive Nevada mortgage Fraud Task Force. With Kelleher gone, the Task Force looks like its work is all but over, as reported in local Las Vegas Channel 8 News:

“Nevada’s mortgage Fraud Task Force — arguably among the most aggressive in the country — has undergone some dramatic changes in the last few months. The changes prompted its former chief to question whether those responsible for Nevada’s housing collapse will ever be brought to justice.”In the report, Kelleher told Channel 8: “It’s my personal opinion that there was some kind of deal cut, involving signing the multi-state (agreement) for whatever reason: financial, political, you can speculate all day long and back off criminal.”

Along with Kelleher, several other Nevada prosecutors and investigators have since been reassigned or transferred out to pasture. In the courts, a Nevada judge all but gutted the AG’s criminal case against Lender Processing Servicers.

Over in Missouri, the state’s criminal case was recently quietly settled for a paltry sum, and forgotten about.

Meanwhile in LPS’s headquarter state of Florida, the attorney general Pam Bondi has done everything to protect LPS, even firing two of her office’s attorneys who made the mistake of investigating LPS fraud.

Hugh Harris, CEO of Lender Processing Services, recently named “One of the Best Places To Work In Northeast Florida”

In a recent celebratory conference call

that Lender Processing Servicers held with financial analysts, Hugh

Harris, the CEO of Lender Processing, could barely contain himself as he

gloated to analysts from Barcalys, Goldman Sachs and other financial institutions:“First, let me just say we are very pleased to report strong second-quarter operating performance…we’ve gained greater clarity over the potential resolution of legal and regulatory issues related to the past practices.So Tracy Lawrence’s highly suspect suicide is another major victory for the bankster class, and another giant loss for the rest of us. No matter what the circumstances of her suicide—that is, even if she was driven to kill herself in despair, after turning whistleblower and facing the pressure of confronting one of the biggest criminal fraud scams in history—that doesn’t make her death any less significant, or infuriating, or disturbing. Either way, the criminal lending industry drove a lone and lonely hero to her death.

“First, we announced yesterday, we’ve settled all our legal issues with the Missouri Attorney General’s office. This settlement includes a dismissal of all criminal charges filed against DocX. Second, an motion to dismiss in the Nevada Attorney General’s case was granted in part which resulted in the scope of the suit being significantly narrowed.”

All we can for now—while this country is still controlled by a rank oligarchy— is remember Tracy Lawrence’s suicide, so that some day we can learn what drove this hero to her terrifying early grave.

Death by Foreclosure. RIP Larry Delassus. Shameful.

Disabled Navy Veteran Died in Court Fighting Foreclosure

Posted March 13th, 2013 by US Navy SEALs

Such was the case of a 62-year-old disabled Navy veteran who fought against Wells Fargo to get his home back.

Such was the case of a 62-year-old disabled Navy veteran who fought against Wells Fargo to get his home back.Larry Delassus, of Hermosa Beach, CA., succumbed to a heart attack on December 19, 2012 while attending a preliminary hearing in Torrance Courthouse.

Delassus, who was in a wheelchair, was suffering from a rare disease called Budd-Chiari syndrome. According to his deposition, he served in the U.S. Navy from 1969 to 1973 and handled jet fuel, and later worked as a production assistant in independent films and for U.S. Airways at LAX International Airport.

In 1996, Delassus bought his 1-bedroom condo unit at 320 Hermosa Avenue. The problem began when his March 2009 payment of $1,237 wasn’t processed as he expected, Easy Reader reports. Even though the late Navy veteran paid his mortgage two months in advance since 2007, the bank later informed him that his payment wasn’t sufficient, and he was suddenly behind on his mortgage payments.

However, Delassus’ friend and lawyer, Anthony Trujillo of Redondo Beach, discovered that the banked used an incorrect assessor’s parcel number that corresponded to Delassus’ neighbor’s home. Turns out, it was Delassus’ neighbor who’s behind on his property taxes.

Trujillo informed Wells Fargo of the mistake, which was acknowledged by the company. However, the judge presiding over the hearing sided with the company.

“He was sure that when a judge heard that he was never even late on a payment, that [the judge] would do something,” said Debbie Popovich, a friend who arrived in court with Delassus.

In a statement issued by Wells Fargo after Delassus’ death, it said: “Mr. Delassus’ passing was a tragic event and our deepest sympathies go out to his family and friends. In a tentative ruling posted on the court’s Web site the night before the scheduled hearing, the judge indicated she was prepared to dismiss all the claims put forward by Mr. Delassus’ attorneys and rule in favor of our motion for summary judgment. Given that there was no testimony or evidence to be presented at the hearing, there was no reason for Mr. Delassus to attend and it is truly unfortunate that he was brought there.”

Trujillo, however, maintained that Delassus was at the court to testify.

Judge Ellison was expected to have had made a decision by Jan. 17 whether the case will go to trial.

Foreclosure Officially Withdrawn by JPMC. Michelle Hansen of Aurora Colorado. Message Stays Up.

As of March 12, 2013 the foreclosure was officially withdrawn.

So, what's next? Well, I was asked to fax over all the documentation that the Executive Office didn't have, but I have actually seen it in their system...they have had it officially for 8 months, but I sent it again with the original time stamped faxes for the past two years, just to be sure that they have just about everything that I have.

So....I have a doctor's appointment for this heart situation...and the ringing in my ears, no doubt the long term consequences of long term chronic stress. Thanks a lot Chase.

The damage has been done. Probably a little more pro-active then hanging myself with their bureaucratic red tape from my rafters.

So, yes I'm still in limbo...it has been over two years, and I keep getting a lot of apologies....a LOT of apologies for how I've been treated, and they can't imagine how I have felt over the past two years and everything I have gone through.

Message is still up. I won't take it down until we have met a resolution to this situation that is FAIR.

So, what's next? Well, I was asked to fax over all the documentation that the Executive Office didn't have, but I have actually seen it in their system...they have had it officially for 8 months, but I sent it again with the original time stamped faxes for the past two years, just to be sure that they have just about everything that I have.

So....I have a doctor's appointment for this heart situation...and the ringing in my ears, no doubt the long term consequences of long term chronic stress. Thanks a lot Chase.

The damage has been done. Probably a little more pro-active then hanging myself with their bureaucratic red tape from my rafters.

So, yes I'm still in limbo...it has been over two years, and I keep getting a lot of apologies....a LOT of apologies for how I've been treated, and they can't imagine how I have felt over the past two years and everything I have gone through.

Message is still up. I won't take it down until we have met a resolution to this situation that is FAIR.

Sunday, March 10, 2013

RIP Joe Tummons. Suicide Caused By Foreclosure.

Thursday March 7, 2013

UPDATE: Businessman facing home foreclosure commits suicide

by Jared Hunt

Daily Mail Business Editor

File photo

Joe

Tummons, 63, fatally shot himself Thursday as officials arrived to

evict him from his home. Tummons, who was facing foreclosure, was the

owner of Joe's Mart in St. Albans.

Police say Joe Tummons, 63, shot himself with a handgun after process servers told him he needed to leave his home.

Tummons was the owner of the Joe's Mart convenience store in St. Albans.

St. Albans Police Department Capt. James Agee said process servers with the Kanawha County Sheriff's Department arrived at Tummons' home on the 2800 block of Lincoln Avenue around 10 a.m. Thursday to serve eviction papers.

Agee said Tummons had been facing financial difficulties of late and was aware that officials were moving forward with foreclosure proceedings on his property.

"He knew it was coming," Agee said. "They had talked with him since mid- to late February."

Agee said the process servers met Tummons at his door, asked him to gather his things and then waited outside his home. He said Tummons did not seem resistant to the officers' requests.

"About 20 or 30 minutes went by and they checked back and asked him how it was going," Agee said. "He said, 'OK, give me a minute,' and then a few minutes later they heard the shot."

Tummons moved to St. Albans from Pennsylvania several decades ago. He did not have any family in the area.

Deputies worked all Thursday to find one of Tummons' relatives to inform them of the incident. Agee said police finally got in touch with Tummons' sister in Texas

*******************************************************************************

Anyone else as pissed off as I am? We are treated like absolute nothings.... not human. Yeah, well my answer is really simple....

http://www.chasemenails.com/ I'm a woman in Aurora Colorado that isn't backing down.

Saturday, March 9, 2013

June Clarkson and Theresa Edwards Fired WhistleBlowers. Fired for Political Reasons.

June Clarkson and Theresa Edwards Were Fired After Revealing Widespread Foreclosure Fraud

June Clarkson went to Ernie's Bar-B-Q in Fort Lauderdale to have lunch with her supervisor, Bob Julian; and some coworkers. It was a Friday in May 2011, the end of a hectic workweek at the local economic crimes unit of the Office of the Attorney General.

Clarkson, a small, lively woman with glasses and blond hair, had left

a private law firm to accept the sub-$60,000-a-year job. She relished

the idea of being a public watchdog, of digging into the records of

companies to catch them trying to cheat customers.

"It was just right up my alley: people defrauding other people, companies defrauding the public. I thought it was the best thing that had ever fallen into my lap," Clarkson recalls.

She worked closely with colleague Theresa Edwards. Their typical assignments involved consumer fraud, but in 2010, they started getting calls from hard-up homeowners. Millions of families had faced foreclosure in the wake of the housing collapse; most had capitulated under the power of giant banks and simply surrendered their homes. But more and more, Clarkson was hearing from individuals who were fighting back.

These homeowners noticed mistakes in the documents that the banks were using as the basis to seize people's homes: strange signatures, missing information, notary seals with no signature, dates in the future. Skeptics began wondering whether these were in fact not innocent mistakes but symptoms of intentional and possibly systemic fraud. Clarkson and Edwards were some of the first public officials willing to listen to these accusations.

Clarkson noticed Julian's phone ringing during lunch but didn't pay much attention. They drove back to the downtown Fort Lauderdale office building they shared with several of the area's most powerful law firms.

Clarkson returned to her desk, reading through piles of documents. Recently she had been investigating Lender Processing Services (LPS), a company that, by some estimates, helped prepare paperwork for half the foreclosures in the country. Every time she found a red flag — a suspect signature, perhaps, or an intriguing memo — she went next door to Julian's office and showed him. But since lunch, he hadn't been acting normally, she thought. Clarkson came back a couple of times, and each time she announced a discovery, it seemed to pain Julian. Eventually he closed his door, but Clarkson knocked again. Julian just looked up at her. She thought he might be sick. "What's the matter?" she asked. "I'm doing a good job!"

"I know," she remembers him saying. She left and closed the door.

Edwards came back from a morning of depositions and stopped by Julian's office. She was tall and calm-voiced with reddish-brown hair, more experienced at the AG's office than Clarkson.

"Get June and come in here," he told her.

He cut straight to the chase: "You're both done at the end of the day. It's a done deal, all the way up to Tallahassee. You can either quit or be terminated," they remembered him saying.

Clarkson and Edwards left the office, stunned. Edwards had known Julian since law school, and the three of them had worked closely together. The two investigators considered themselves the hardest-working people in the office and had recently received a commendation for their work. Julian had encouraged them to go after the foreclosure-fraud cases with all they had, and they even helped win a $2 million settlement with the foreclosure law firm of Marshall Watson, which had been accused of fudging its documents. So what happened?

The women say that, at the time, they had no idea. But over the past year, as supporters have rallied to their side, they've started to believe they were ousted for political reasons. Going after powerful law firms and banks didn't sit too well with the state's new, business-friendly Republican administration, including Gov. Rick Scott and Attorney General Pam Bondi.

Since their ouster, the women have moved on to private practice and become heroes to some, though their power in court is a shadow of their former influence. Meanwhile, the mortgage industry has not exactly gotten its papers in order.

The complicated system of investments that underlies the industry — mortgage-backed securities, government-sponsored enterprises — may seem distant and fanciful to buyers when they sign on the dotted line and buy into the American dream of home ownership. But the demanding letters that can suddenly show up in the mail — pay now or lose your home — are undeniably real. What if the documentation to back up the bank's claim to your house were missing or incomplete, if the bank was deriving its power from a few pieces of paper slapped together at a document mill? How would you know?

One Saturday afternoon in May 2010, Clarkson was manning the attorney general's table at a mortgage-fraud seminar at Florida International University in Miami. Much of the discussion was about two-bit scams, like companies offering too-good-to-be-true loan modifications. A woman came up to the table. "I've been trying to get in touch with you," said Lisa Epstein, a sharp-eyed brunet in her 40s.

Epstein, a registered nurse, was going through a divorce and had started to worry about money. She asked her lender, Chase Bank, to help work out a solution that would lower her monthly payments. "I had excellent credit and had never paid a bill late," she says. That inquiry led to two surprises: First, Chase told her that another bank, Wells Fargo, was involved and would not allow any sort of loan modification. Second, after weeks of persistence, Chase suggested that no modification would ever happen unless she stopped paying her mortgage for three months.

After getting booted from the Attorney General's

Office a year ago, June Clarkson (left) and Theresa Edwards started a

private law partnership in Fort Lauderdale.

Lisa Epstein was one of the first people to bring

faulty documents to Clarkson and Edwards and is currently running for

Palm Beach clerk of courts.

"It was just right up my alley: people defrauding other people, companies defrauding the public. I thought it was the best thing that had ever fallen into my lap," Clarkson recalls.

She worked closely with colleague Theresa Edwards. Their typical assignments involved consumer fraud, but in 2010, they started getting calls from hard-up homeowners. Millions of families had faced foreclosure in the wake of the housing collapse; most had capitulated under the power of giant banks and simply surrendered their homes. But more and more, Clarkson was hearing from individuals who were fighting back.

These homeowners noticed mistakes in the documents that the banks were using as the basis to seize people's homes: strange signatures, missing information, notary seals with no signature, dates in the future. Skeptics began wondering whether these were in fact not innocent mistakes but symptoms of intentional and possibly systemic fraud. Clarkson and Edwards were some of the first public officials willing to listen to these accusations.

Clarkson noticed Julian's phone ringing during lunch but didn't pay much attention. They drove back to the downtown Fort Lauderdale office building they shared with several of the area's most powerful law firms.

Clarkson returned to her desk, reading through piles of documents. Recently she had been investigating Lender Processing Services (LPS), a company that, by some estimates, helped prepare paperwork for half the foreclosures in the country. Every time she found a red flag — a suspect signature, perhaps, or an intriguing memo — she went next door to Julian's office and showed him. But since lunch, he hadn't been acting normally, she thought. Clarkson came back a couple of times, and each time she announced a discovery, it seemed to pain Julian. Eventually he closed his door, but Clarkson knocked again. Julian just looked up at her. She thought he might be sick. "What's the matter?" she asked. "I'm doing a good job!"

"I know," she remembers him saying. She left and closed the door.

Edwards came back from a morning of depositions and stopped by Julian's office. She was tall and calm-voiced with reddish-brown hair, more experienced at the AG's office than Clarkson.

"Get June and come in here," he told her.

He cut straight to the chase: "You're both done at the end of the day. It's a done deal, all the way up to Tallahassee. You can either quit or be terminated," they remembered him saying.

Clarkson and Edwards left the office, stunned. Edwards had known Julian since law school, and the three of them had worked closely together. The two investigators considered themselves the hardest-working people in the office and had recently received a commendation for their work. Julian had encouraged them to go after the foreclosure-fraud cases with all they had, and they even helped win a $2 million settlement with the foreclosure law firm of Marshall Watson, which had been accused of fudging its documents. So what happened?

The women say that, at the time, they had no idea. But over the past year, as supporters have rallied to their side, they've started to believe they were ousted for political reasons. Going after powerful law firms and banks didn't sit too well with the state's new, business-friendly Republican administration, including Gov. Rick Scott and Attorney General Pam Bondi.

Since their ouster, the women have moved on to private practice and become heroes to some, though their power in court is a shadow of their former influence. Meanwhile, the mortgage industry has not exactly gotten its papers in order.

The complicated system of investments that underlies the industry — mortgage-backed securities, government-sponsored enterprises — may seem distant and fanciful to buyers when they sign on the dotted line and buy into the American dream of home ownership. But the demanding letters that can suddenly show up in the mail — pay now or lose your home — are undeniably real. What if the documentation to back up the bank's claim to your house were missing or incomplete, if the bank was deriving its power from a few pieces of paper slapped together at a document mill? How would you know?

One Saturday afternoon in May 2010, Clarkson was manning the attorney general's table at a mortgage-fraud seminar at Florida International University in Miami. Much of the discussion was about two-bit scams, like companies offering too-good-to-be-true loan modifications. A woman came up to the table. "I've been trying to get in touch with you," said Lisa Epstein, a sharp-eyed brunet in her 40s.

Epstein, a registered nurse, was going through a divorce and had started to worry about money. She asked her lender, Chase Bank, to help work out a solution that would lower her monthly payments. "I had excellent credit and had never paid a bill late," she says. That inquiry led to two surprises: First, Chase told her that another bank, Wells Fargo, was involved and would not allow any sort of loan modification. Second, after weeks of persistence, Chase suggested that no modification would ever happen unless she stopped paying her mortgage for three months.

Epstein was aghast at losing her pristine credit score, but she

complied and stopped paying. After 90 days, she heard nothing. Around

day 117 or so, by her count, she got a knock on the door and was served

with foreclosure papers. Epstein was confused when she examined the

documents and saw that the company attempting to seize her home was not

Chase or Wells Fargo but U.S. Bank.

Epstein began spending her days off at the courthouse, sitting in on foreclosure-court proceedings to acquaint herself with the baffling intricacies of the system. She also looked up other people's documents in the public record. She noticed a pattern in documents that, like hers, had been signed by two women with the same last name: Erin and Lisa Cullaro. In many instances, both the signature and notary lines had the same handwriting; it seemed like one or the other would just sign both of the names. After a little digging, she learned that they were sisters-in-law who both worked at a law firm called Florida Default Law Group in Tampa.

Epstein brought her documents when she finally met with Clarkson and

Edwards in the conference room at their downtown office. Epstein slid a

piece of paper across the table. Clarkson and Edwards realized, to their