:) thought this was an appropriate share for the day...."Fierce" I think I like it...I like it A LOT.

This is where I'm at...and it is a Beautiful Place to be, Funny, "If it isn't Okay, then it isn't the END, It will BE OKAY in the End."

Thought of the day, "Can you put a Dollar $ figure on how much this has cost you?" Sure, how many zeros do you think would sum things up?? LOLOLOLOLOLOLOL EXACTLY.

Thursday, May 31, 2012

Illinois State Representative Mike Bost Freak Out Rants Read the Bill

THIS IS HOW I FEEL...Wouldn't it be wonderful if everyone stood up and told the truth? Mike Bost, you are not alone, you are frustrated, so is the rest of America! I agree with everything you have said, who am I? Just an American who believes that the Constitution of The United States of America Hangs in the balance.... It's all horrifying isn't it? We have been spoon fed that we live in a Democracy, and here we are being blocked to even make a change. TOO BIG, isn't GOOD. So, what do we do? There are rules, for rules for rules and all I can see is NOTHING is getting done, NOTHING is getting BETTER....I applaud you for having the guts to tell the TRUTH, it is sad that it needs to get to an explosive frustration...but hey you got "their" attention didn't you? I have learned a brilliant lesson this week, if you can't beat em' Join them. WHEN you JOIN THEM, Then you can BEAT THEM AT THEIR OWN GAME.

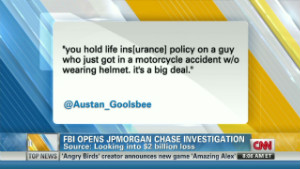

You Hear That JPMORGANCHASE? :) I LOVE YOU SO MUCH, I have found a wonderful way for you to have to LEGALLY TALK WITH ME...It's so CRAZY it is GENIUS... Can't WAIT!!!! :)

Wednesday, May 30, 2012

Most Interesting Conversation to Date: MY JAW HIT THE FLOOR!

Today I had a wonderful conversation with a broker of insurance and works and runs a successful business in the "Securities" business. (We talked about many things, which is helping me with my book :) (along with some whistle help)

We talked about the wonder that is JPMorgan Chase and here is the general synopsis of the conversation:

JPMorgan needs to get rid of your home, they have already been paid for it, and now they are trying as fast as possible to just get rid of all of "their damage"

My message to JPMorgan Chase and their illustrious "customer service agents" as well as Jamie Dimon is this:

I'M NOT GOING TO LEAVE MY HOME, YOU CAN IGNORE ME, YOU CAN THREATEN ME, YOU CAN STALK MY HOME, YOU CAN KEEP DOING YOUR RANDOM STOP BYS,

I WILL CHALLENGE YOU, in ONE YEAR You have done the unthinkable, but then again so have I....SO what is the difference between me and JPMorganChase??

MY SPINE IS STILL INTACT, but I would love for you to prove me wrong. I dare you...PROVE ME WRONG!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

:) I LOVE YOU JPMorgan Chase, for teaching me the lesson of tenacity...however YOU have really picked the wrong person to do this all to, SHAME, SHAME, SHAME on you!!!!!!!!!!!!!!!!!!!!!!!!!!

We talked about the wonder that is JPMorgan Chase and here is the general synopsis of the conversation:

JPMorgan needs to get rid of your home, they have already been paid for it, and now they are trying as fast as possible to just get rid of all of "their damage"

My message to JPMorgan Chase and their illustrious "customer service agents" as well as Jamie Dimon is this:

I'M NOT GOING TO LEAVE MY HOME, YOU CAN IGNORE ME, YOU CAN THREATEN ME, YOU CAN STALK MY HOME, YOU CAN KEEP DOING YOUR RANDOM STOP BYS,

I WILL CHALLENGE YOU, in ONE YEAR You have done the unthinkable, but then again so have I....SO what is the difference between me and JPMorganChase??

MY SPINE IS STILL INTACT, but I would love for you to prove me wrong. I dare you...PROVE ME WRONG!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

:) I LOVE YOU JPMorgan Chase, for teaching me the lesson of tenacity...however YOU have really picked the wrong person to do this all to, SHAME, SHAME, SHAME on you!!!!!!!!!!!!!!!!!!!!!!!!!!

Jamie Dimon $23 Million Payday isn't the problem (Then What is?)

There just isn't enough aspirin in the world to get rid of this headache of mine. Another week of total brain damage...but I have a plan, and it is so "Crazy" it might just work...because "doing the right thing" in "good faith" doesn't compute with the Wonder that is JPMorgan Chase. **Stay Tuned**

***************************

Dimon's $23 million payday isn't the problem

By Ingo Walter and Jennifer Carpenter, Special to CNN

updated 8:36 AM EDT, Fri May 18, 2012

A cutout figure of JPMorgan Chase CEO Jamie Dimon hovers above a May 2011 protest against banks on Wall Street.

STORY HIGHLIGHTS

- JPMorgan CEO Jamie Dimon gets $23 million pay package despite the bank's $2 billion loss

- Ingo Walter and Jennifer Carpenter: Real concern should not be level of executive pay

- They say bank shareholders and employees have incentives to take risks to make more money

- Focus on changing risk incentives rather than amount of pay, the writers say

Editor's note: Ingo

Walter is the Seymour Milstein professor of finance, corporate

governance and ethics, and Jennifer Carpenter is an associate professor

of finance in the Stern School of Business at New York University.

(CNN) -- Here we go again. The perennial question

of: "Would you rather own shares in a major financial conglomerate or

manage one?" comes up as JPMorgan Chase loses more than $2 billion in

trading bets.

The answer seems clear.

If you're an executive who manages the money, you're likely to get a

large paycheck and bonus even if you're responsible for the loss,

directly or indirectly. Jamie Dimon is still getting his $23 million.

Shares of the major banks

continue to trade well below book value and generate miserable

performance metrics -- and have over the years been very poor

investments -- while senior executives and key employees continue to

walk away with vastly outsize earnings, even when they oversee massive

losses.

Shareholders certainly

have reasons to object to huge executive pay packages, especially

ordinary people whose fund managers have put in stakes of the bank

shares in their pension and mutual fund accounts.

But the level of

executive compensation comes out of shareholders' pockets. If

shareholders are unhappy with the division of the spoils, they have no

one to blame but themselves. After all, they can always take their money

elsewhere if they don't think their cut of bank profits is big enough.

The real concern for

everyone -- including regulators and taxpayers -- is not the level of

pay handed out to executives, nor how profits in a company are divided

between employees and shareholders, but rather, the incentives for

risk-taking that bank pay apparently continues to create.

Follow @CNNOpinion on Twitter and Facebook.com/cnnopinion.

Regulators have called

for deferred compensation to address the incentive problem. If deferred

compensation presents employees with serious exposure to potentially big

losses, they'll have a major stake in the long-term solvency of the

business and help spare taxpayers the cost of bailing out firms that

have become too systemically important to fail.

FBI looking into bank's huge loss

FBI looking into bank's huge loss

Professor: Fair to question Volcker Rule

Professor: Fair to question Volcker Rule

From AIG to JPMorgan, why London?

From AIG to JPMorgan, why London?

Carney: Well-run bank can make bad calls

Carney: Well-run bank can make bad calls

But forcing employees to

bear significant exposure to potentially big losses may come at a price.

Employees may require higher salaries to compensate for increased risk.

We're seeing this reflected in recently announced pay packages. The

price is paid primarily by shareholders while the benefits of any

improvement in financial stability accrue to society as a whole.

Deferred cash

compensation makes employees debt holders, so it ought to reduce

risk-taking. So should compensation in a form that explicitly converts

to equity when the firm gets into trouble and is bailout-proof.

Deferred stock

compensation, however, may do just the opposite. As long as there are

implicit government guarantees for financial institutions that are

considered too big, too complex or too interconnected to fail, the value

of those institutions' stocks increases with risk-taking.

The more risk a bank

takes, the greater the value of government guarantees and potential

bailouts. This value gets passed on to the bank's stock price. If

employees are paid in deferred stock, the risk incentives are then

passed on to them, encouraging them to speculate.

Rules that mandate more pay in the form of stock miss the point. It helps align the interests of employees and shareholders, but it fails to align their interests with those of taxpayers.

Ultimately, it's the

taxpayers who are held hostage. They care about the size of bailout

necessitated by excessive risk-taking taken by banks, and about economic

growth, but not about how bank profits are divided per se, since they

don't get a cut in any case.

Regulators are aware

that bank stockholders have an overriding desire to take more risk than

is good for society because chronic under-pricing of government

guarantees makes it profitable for banks to seek risky assets and lever

them as much as possible. This is the reason for capital requirements

and the Volcker Rule, which tries to restrict risk-taking.

Recent attempts to

reform compensation overlook how complicated the compensation process

can be. Trying to discourage risky behavior is like fighting an uphill

battle against shareholders who like risk. Moreover, risk incentives are

harder to measure, and their regulation is easy to circumvent.

Criticizing the

compensation packages of JPMorgan's Dimon and his senior associates

might be popular with voters, but regulators would be better off

focusing on the source of the problem -- the mispricing of government

guarantees that create perverse risk incentives in the first place.

Pricing deposit

insurance differently or banning activities such as proprietary trading

would give shareholders and employees alike an incentive to rein in

risk-taking. Employee compensation would then reform itself.

Wednesday, May 23, 2012

Meet My New Friend, I Just Need a Minute, or 5 of your time!

Meet John W. Suthers the 37th Attorney General of Colorado. I'm gonna go knock on some doors, see if being tenacious gets me anywhere? I'll keep you updated. :)

Meet John W. Suthers the 37th Attorney General of Colorado. I'm gonna go knock on some doors, see if being tenacious gets me anywhere? I'll keep you updated. :)

JPMorgan Other Huge Derivatives Losses. (Say What?)

Don't Forget About JPMorgan's Other Huge Derivatives Losses

In an August 2010 commentary about JPMorgan's losses in coal

trades I wrote: "The commodities division isn't the only area in which

JPMorgan is vulnerable. Credit derivatives, interest rate derivatives,

and currency trading are vulnerable to leveraged hidden bets. Ambitious managers strive to pump speculative earnings from zero to hero."

At issue is corporate governance at JPMorgan and the ability of its CEO, Jamie Dimon, to manage its risk. It's reasonable to ask whether any CEO can manage the risks of a bank this size, but the questions surrounding Jamie Dimon's management are more targeted than that. The problem Jamie Dimon has is that JPMorgan lost control in multiple areas. Each time a new problem becomes public, it is revealed that management controls weren't adequate in the first place.

JPMorgan's Derivatives Blow Up Again

Jamie Dimon's problem as Chairman and CEO--his dual role raises further questions about JPMorgan's corporate governance---is that just two years ago derivatives trades were out of control in his commodities division. JPMorgan's short coal position was over sized relative to the global coal market. JPMorgan put this position on while the U.S. is at war. It was not a customer trade; the purpose was to make money for JPMorgan. Although coal isn't a strategic commodity, one should question why the bank was so reckless.

After trading hours on Thursday of this week, Jamie Dimon held a conference call about $2 billion in mark-to-market losses in credit derivatives (so far) generated by the Chief Investment Office, the bank's "investment" book. He admitted:

"In hindsight, the new strategy was flawed, complex, poorly reviewed, poorly executed, and poorly monitored."

But lets get back to commodities. For several years, legendary investor Jim Rogers has expressed his concern to me about JPMorgan's balance sheet, credit card division, and his belief that Blythe Masters, the head of JPMorgan's commodities area, knows so little about commodities. Jim Rogers is an expert in commodities and is the creator or the Rogers International Commodities Index. He also sells out-of-the-money calls on JPMorgan stock. So far, that strategy has worked out well for him. (Rogers gave me permission to publicly reflect his views and his trades.) Moreover, JPMorgan is still grappling with potential legal liabilities related to the mortgage crisis.

Is Jim Rogers justified in his harsh view of JPMorgan's commodities division? After he expressed his concerns, JPMorgan's coal trade made the news, and it appeared to me that Jim Rogers is on to something. For those of you who missed it the first time, my August 9, 2010 commentary is reproduced below in its entirety. Dawn Kopecki at Bloomberg/BusinessWeek broke the story wherein Blythe Masters' quotes first appeared:

JPMorgan's Losses from Indecent Overexposure - August 9, 2010

JPMorgan Chase's fixed-income revenue fell almost 28% to $3.6 billion in the second quarter, down from $5.5 billion in the first quarter, and down from $4.9 billion for the same period last year. JPMorgan blamed an interest rate squeeze and bad results in the credit markets and the commodities markets.

There were no details of its significant loss from unwise, gigantic, wrong-way wartime coal bets. The bank took a short position so enormous that it was oversized relative to the global coal market, and second quarter losses reportedly were in the hundreds of millions of dollars.

Financial Reform Failure

Blythe Masters, managing director in charge of JPMorgan's global commodities group, spent time lobbying in Washington to dilute financial reform. By her own admission, JPMorgan's recent speculation in coal wasn't client driven; the risk was taken on JPMorgan's behalf. The Dodd-Frank Financial Reform Bill does nothing to prevent a repeat -- or even a potentially worse -- debacle.

The commodities division isn't the only area in which JPMorgan is vulnerable. Credit derivatives, interest rate derivatives, and currency trading are vulnerable to leveraged hidden bets. Ambitious managers strive to pump speculative earnings from zero to hero.

Instead of transparent and regulated markets, we have dark markets, hidden leverage, proprietary speculative trading, lax regulation and oversized risks.

"Scared Sh*tless" 1

Blythe Masters told her remaining employees that competitors are "scared sh*tless" of JPMorgan's commodities division. She claimed the layoffs of 10% of front office staff are not a sign of JPMorgan "panicking" and called the risk taking in coal trading that left JPMorgan wide-open to a massive short squeeze a "rookie error."

For individual traders, JPMorgan doesn't follow the Wall Street maxim: He who sells what isn't his'n, must buy it back or go to pris'n. The U.S. can count on JPMorgan to continue both long and short market manipulation and take its winnings and losses from blind gambles. Shareholders, taxpayers, and consumers will foot the bill for any unpleasant global consequences.

Physical oil traders from JPMorgan's brand new RBS Sempra Commodities LLP acquisition (JPMorgan paid $1.7 billion) left of their own accord to join smaller firms with less capital. Masters said these were "very interesting career decisions."

The defections were all the more interesting, because Masters began her career as a JPMorgan commodities trader. RBS Sempra's oil traders gave Masters a vote of no confidence. Their flight was a loss of "key people," whom she said she needs to replace.

Masters is poised for more debacles:

"All it's going to take is a little pop to the upside. We could be producing a 30 to 35 percent ROE and looking like gods."

Good luck with that. Masters also noted that this potential windfall might come at the expense of others:

"We've got too many banks chasing too little volume and margins have compressed."

The United States is trying to pull out of the greatest financial tailspin in its history. Dice-rolling braggadacio by a key officer at one of the nation's largest banks is exactly the kind of thing Congress, taxpayers, and voters should find scary. Arianna Huffington explains the consequences for middle class Americans, who pay a disproportionate share of the bill in her upcoming book, Third World America. 2

Ramp up Risk and Cross Your Fingers

Big unanticipated market moves always result in big winners and big losers among big gamblers. After the fact, most winners claim they were smart--not just lucky.

When bank managers take a big gamble and lose hundreds of millions of dollars, they don't call it reckless; they spin it as an error of "judgment." The directive is to "put on risk" and "generate results." This may be why Masters cautioned employees:

"I don't want us talking to the outside world, neither about successes nor about failures."

JPMorgan is making big bets and crossing its fingers in a dangerous and volatile market.

Masters takes "pleasure" in the "ballsiest" business, and she wants her traders to get lucky. Moreover, she's engaged in internal spin control and plans a "deep dive" with the Board and the CFO. This may reduce her chances of walking Wall Street.

No one should be concerned for the job security of managers like Masters at JPMorgan, and that is precisely the problem. Delusional risk-taking and lack of transparency at Too-Big-To-Fail banks -- especially in the areas most vulnerable to rampant speculation -- were ignored by so-called financial reform.

1 All words in this article in quotation marks are from Business Week's (Bloomberg News) major scoop after the leak of a tape of an internal JPMorgan July 22 conference call: "Blythe Masters Says 'Don't Panic' as Commodities Slip," by Dawn Kopecki, August 3, 2010.

2 Based on my reading of an advance copy of Arianna Huffington's new book: Third World America: How Our Politicians Are Abandoning the Middle Class and Betraying the American Dream, Crown Books, September 2010.

Endnote: Jane Wollman Rusoff interviewed me for Research Magazine's May cover story, "Finding the Culprits of the Crisis," about the deep monetary connections of Wall Street and Washington and the corrosive effect it has had on the economy and the Republic. Read more posts on Tavakoli Structured Finance »

At issue is corporate governance at JPMorgan and the ability of its CEO, Jamie Dimon, to manage its risk. It's reasonable to ask whether any CEO can manage the risks of a bank this size, but the questions surrounding Jamie Dimon's management are more targeted than that. The problem Jamie Dimon has is that JPMorgan lost control in multiple areas. Each time a new problem becomes public, it is revealed that management controls weren't adequate in the first place.

JPMorgan's Derivatives Blow Up Again

Jamie Dimon's problem as Chairman and CEO--his dual role raises further questions about JPMorgan's corporate governance---is that just two years ago derivatives trades were out of control in his commodities division. JPMorgan's short coal position was over sized relative to the global coal market. JPMorgan put this position on while the U.S. is at war. It was not a customer trade; the purpose was to make money for JPMorgan. Although coal isn't a strategic commodity, one should question why the bank was so reckless.

After trading hours on Thursday of this week, Jamie Dimon held a conference call about $2 billion in mark-to-market losses in credit derivatives (so far) generated by the Chief Investment Office, the bank's "investment" book. He admitted:

"In hindsight, the new strategy was flawed, complex, poorly reviewed, poorly executed, and poorly monitored."

But lets get back to commodities. For several years, legendary investor Jim Rogers has expressed his concern to me about JPMorgan's balance sheet, credit card division, and his belief that Blythe Masters, the head of JPMorgan's commodities area, knows so little about commodities. Jim Rogers is an expert in commodities and is the creator or the Rogers International Commodities Index. He also sells out-of-the-money calls on JPMorgan stock. So far, that strategy has worked out well for him. (Rogers gave me permission to publicly reflect his views and his trades.) Moreover, JPMorgan is still grappling with potential legal liabilities related to the mortgage crisis.

Is Jim Rogers justified in his harsh view of JPMorgan's commodities division? After he expressed his concerns, JPMorgan's coal trade made the news, and it appeared to me that Jim Rogers is on to something. For those of you who missed it the first time, my August 9, 2010 commentary is reproduced below in its entirety. Dawn Kopecki at Bloomberg/BusinessWeek broke the story wherein Blythe Masters' quotes first appeared:

JPMorgan's Losses from Indecent Overexposure - August 9, 2010

JPMorgan Chase's fixed-income revenue fell almost 28% to $3.6 billion in the second quarter, down from $5.5 billion in the first quarter, and down from $4.9 billion for the same period last year. JPMorgan blamed an interest rate squeeze and bad results in the credit markets and the commodities markets.

There were no details of its significant loss from unwise, gigantic, wrong-way wartime coal bets. The bank took a short position so enormous that it was oversized relative to the global coal market, and second quarter losses reportedly were in the hundreds of millions of dollars.

Financial Reform Failure

Blythe Masters, managing director in charge of JPMorgan's global commodities group, spent time lobbying in Washington to dilute financial reform. By her own admission, JPMorgan's recent speculation in coal wasn't client driven; the risk was taken on JPMorgan's behalf. The Dodd-Frank Financial Reform Bill does nothing to prevent a repeat -- or even a potentially worse -- debacle.

The commodities division isn't the only area in which JPMorgan is vulnerable. Credit derivatives, interest rate derivatives, and currency trading are vulnerable to leveraged hidden bets. Ambitious managers strive to pump speculative earnings from zero to hero.

Instead of transparent and regulated markets, we have dark markets, hidden leverage, proprietary speculative trading, lax regulation and oversized risks.

"Scared Sh*tless" 1

Blythe Masters told her remaining employees that competitors are "scared sh*tless" of JPMorgan's commodities division. She claimed the layoffs of 10% of front office staff are not a sign of JPMorgan "panicking" and called the risk taking in coal trading that left JPMorgan wide-open to a massive short squeeze a "rookie error."

For individual traders, JPMorgan doesn't follow the Wall Street maxim: He who sells what isn't his'n, must buy it back or go to pris'n. The U.S. can count on JPMorgan to continue both long and short market manipulation and take its winnings and losses from blind gambles. Shareholders, taxpayers, and consumers will foot the bill for any unpleasant global consequences.

Physical oil traders from JPMorgan's brand new RBS Sempra Commodities LLP acquisition (JPMorgan paid $1.7 billion) left of their own accord to join smaller firms with less capital. Masters said these were "very interesting career decisions."

The defections were all the more interesting, because Masters began her career as a JPMorgan commodities trader. RBS Sempra's oil traders gave Masters a vote of no confidence. Their flight was a loss of "key people," whom she said she needs to replace.

Masters is poised for more debacles:

"All it's going to take is a little pop to the upside. We could be producing a 30 to 35 percent ROE and looking like gods."

Good luck with that. Masters also noted that this potential windfall might come at the expense of others:

"We've got too many banks chasing too little volume and margins have compressed."

The United States is trying to pull out of the greatest financial tailspin in its history. Dice-rolling braggadacio by a key officer at one of the nation's largest banks is exactly the kind of thing Congress, taxpayers, and voters should find scary. Arianna Huffington explains the consequences for middle class Americans, who pay a disproportionate share of the bill in her upcoming book, Third World America. 2

Ramp up Risk and Cross Your Fingers

Big unanticipated market moves always result in big winners and big losers among big gamblers. After the fact, most winners claim they were smart--not just lucky.

When bank managers take a big gamble and lose hundreds of millions of dollars, they don't call it reckless; they spin it as an error of "judgment." The directive is to "put on risk" and "generate results." This may be why Masters cautioned employees:

"I don't want us talking to the outside world, neither about successes nor about failures."

JPMorgan is making big bets and crossing its fingers in a dangerous and volatile market.

Masters takes "pleasure" in the "ballsiest" business, and she wants her traders to get lucky. Moreover, she's engaged in internal spin control and plans a "deep dive" with the Board and the CFO. This may reduce her chances of walking Wall Street.

No one should be concerned for the job security of managers like Masters at JPMorgan, and that is precisely the problem. Delusional risk-taking and lack of transparency at Too-Big-To-Fail banks -- especially in the areas most vulnerable to rampant speculation -- were ignored by so-called financial reform.

1 All words in this article in quotation marks are from Business Week's (Bloomberg News) major scoop after the leak of a tape of an internal JPMorgan July 22 conference call: "Blythe Masters Says 'Don't Panic' as Commodities Slip," by Dawn Kopecki, August 3, 2010.

2 Based on my reading of an advance copy of Arianna Huffington's new book: Third World America: How Our Politicians Are Abandoning the Middle Class and Betraying the American Dream, Crown Books, September 2010.

Endnote: Jane Wollman Rusoff interviewed me for Research Magazine's May cover story, "Finding the Culprits of the Crisis," about the deep monetary connections of Wall Street and Washington and the corrosive effect it has had on the economy and the Republic. Read more posts on Tavakoli Structured Finance »

"...We're Still Going To Earn A Lot Of Money This Quarter" Oh well, that Makes This All Okay Then! Phew, That was a close one!

Meet the Press- "This is not a risk which is life-threatening to

JPMorgan. This is a stupid thing ... that we should never have done, but

we’re still going to earn a lot of money this quarter. So it isn’t like

the company’s jeopardized. We hurt ourselves and our credibility, yes.

And that—we’ve got to fully expect and pay the price for that." Jamie

Dimon CEO, JPMorgan Chase May 13, 2012 — MTP Quotables

Meet the Press- "This is not a risk which is life-threatening to

JPMorgan. This is a stupid thing ... that we should never have done, but

we’re still going to earn a lot of money this quarter. So it isn’t like

the company’s jeopardized. We hurt ourselves and our credibility, yes.

And that—we’ve got to fully expect and pay the price for that." Jamie

Dimon CEO, JPMorgan Chase May 13, 2012 — MTP QuotablesJPMorgan Awards Jamie Dimon $23 Million

When I read this, and all that I have read about the wonder that is Chase and Jamie Dimon...this makes me pause. I read that Jamie Dimon says things like (I'm paraphrasing here) Just because you are rich, doesn't mean you are evil. It is pretty simple really, I don't HATE the wealthy, there isn't a bone in my body that is greedy. I just don't like frauds, or cons, or the old bait and switch. I hear him say that "...we make mistakes..." but I don't see any action to fix it, other than you know, the usual filing foreclosures on people and then refusing to talk to them...hurry quick get rid of the evidence is what I see happening.

Over what is now a year, I have not gotten anywhere with these clowns, it's really frustrating and actually quite stupid. I couldn't quite figure out what the uproar was when everyone was saying, "The Bank Is Stealing My Home!!!" So, very naive to what was really all happening, that I thought surely the banks can't just up and foreclose on someone, surely they have to work something out, surely they aren't forging documents by the thousands and people were just up and leaving their homes in droves. WHY? Well, you don't fight corporate America, you don't fight the "monster that is Chase" you just don't do it. I don't want to fight the "monster that is Chase" I want to invite them over to dinner, or at the very least have gosh, I don't know....a PHONE CALL! This is Silly isn't it?

People closest to me are, "Oh, you are still dealing with that?" "Just walk away" "You don't fight the Bank" I'm going to throw this question out there to anyone that may be listening to this train wreak...Have You Ever Stood Up For Something or Someone, because you knew at your very core that there was an extreme injustice?? I won't lie, it's a scary proposition, because it is an unknown" experience to me...on this grand of a scale. I'm probably a bit of a loose canon, nothing left to lose...my answer always comes down to, How Can I NOT?

JPMorgan Awards CEO Jamie Dimon $23 Million Pay Package

By Dawn Kopecki -

Apr 4, 2012 3:18 PM MT

Dimon’s base salary was raised to $1.5 million beginning in March 2011 from $1 million and he received $17 million in restricted stock and options for his performance in 2011, down from $17.4 million the previous year, the New York-based company said today in a proxy statement. His cash bonus was $4.5 million, down from $5 million in 2010, the bank said.

James "Jamie" Dimon, chairman and chief executive officer of JPMorgan Chase & Co. Photographer: Simon Dawson/Bloomberg

Dimon, 56, received restricted shares valued at $12 million, according to the proxy. He also received options valued at $5 million, based on the company’s calculations.

The CEO took a salary of $1 million for 2009 and gave up bonuses that year and in 2008 after receiving $49.9 million in total compensation for 2007. Dimon and his wife control almost 5.2 million shares valued at more than $209 million as of March 2, when his total holdings were last disclosed.

Tuesday, May 22, 2012

"We Try to do Everything by the Book..." -Jamie Dimon Says. (except talk to clients heehee)

(My response to that statement is simple, I don't think you should "try" I think you should just follow the rules, be in compliance, and perhaps put your ego in check, perhaps pick up the phone and NOT IGNORE your CLIENTS, and perhaps revisit your CODE OF ETHICS, although I can only make suggestions, I know that things are hectic right now. OFFER STILL STANDS, I would like to talk with you, and see perhaps then, if you can acknowledge that I exist....Whatda Say? :) I LOVE YOU Jamie Dimon SO MUCH.)

May 21, 2012, 11:33 amInvestment Banking

JPMorgan to Suspend Stock Buybacks

By NELSON D. SCHWARTZ Keith Bedford/ReutersJamie Dimon, the bank’s chief executive, has apologized.

Keith Bedford/ReutersJamie Dimon, the bank’s chief executive, has apologized.Two months after announcing a $15 billion share buyback program, JPMorgan Chase reversed course on Monday, saying it was halting the repurchases after the bank’s multibillion-dollar trading loss.

Jamie Dimon, the bank’s chief executive, disclosed the move at a meeting with investors sponsored by Deutsche Bank in Manhattan. The buybacks had been set to run through the end of the first quarter of 2013.

Mr. Dimon said the bank intended to keep its dividend of 30 cents a quarter unchanged. Bank officials have repeatedly emphasized that the company has no plans to reduce it despite the trading loss. Initially estimated by the bank at $2 billion, the trading loss on credit derivatives now stands at more than $3 billion, according to traders and regulators.

Related Links

“We are going to wrestle the problem down,” he said.

The decision to halt the repurchases — a move the company said it made on its own, not at the behest of regulators — sent JPMorgan’s shares sliding again Monday, closing at their lowest level since late last year.

JPMorgan, the largest bank in the United States by assets, announced the share repurchase plan and a dividend increase in March, immediately after receiving permission from the Federal Reserve. The Fed subjected JPMorgan and 18 other large financial institutions to a third round of stress tests early this year, tests that JPMorgan passed with flying colors.

While JPMorgan’s balance sheet was “barely nicked” by the trading loss, Mr. Dimon said on Monday, the bank was suspending the repurchases temporarily as part of a “prudent” approach to capital retention. The move also grew out of a desire to stay on track in meeting higher capital requirements under the so-called Basel III regulatory accords.

After the March announcement, JPMorgan’s stock surged, eventually rising to more than $40 a share. The shares have fallen sharply since the announcement of the surprise loss, however. Its shares closed at $32.51 on Monday, down nearly 3 percent.

“It’s disappointing for shareholders,” said Glenn Schorr, an analyst with Nomura. “The bearish interpretation is that this means the losses could be larger. But I think it’s a matter of JPMorgan trying to take ownership of the mistake and get out in front of this.”

Even if the loss were to double to $4 billion, analysts said, the percentage of earnings earmarked for dividends would remain below the crucial 30 percent threshold. If losses were to rise to more than $5 billion, the analysts added, a dividend cut would become more likely.

Mr. Dimon still has fans among analysts on Wall Street, despite the sagging shares. Keith Horowitz, a widely respected analyst with Citigroup, reiterated his buy recommendation on the stock Monday.

The JPMorgan trading debacle is likely to be a focus of legislators on Capitol Hill on Tuesday, when Congress holds a public hearing with top financial regulators. The Senate Banking Committee will hear from the leaders of the Commodity Futures Trading Commission and the Securities and Exchange Commission, both of which are investigating the trading losses. Mr. Dimon is expected to testify before Congress sometime this summer.

Besides being the most embarrassing misstep of Mr. Dimon’s seven-year tenure at the top of JPMorgan, the trading loss has also strengthened the hand of regulators and politicians who favor tighter rules on how the big banks operate. In his radio address on Saturday, President Obama urged tighter restrictions on banks’ trading activity.

The buyback suspension is the first policy change as a result of the trading loss. The bank has already accepted the resignation of Ina Drew, the executive who headed the chief investment office, which was responsible for the loss, and more departures are expected.

The bank’s overall health remains strong, and JPMorgan Chase is still expected to post a substantial profit for the second quarter. Even if the loss were to double to $4 billion, the company would still end up in the black for the quarter.

But the bank’s reputation for superior risk management has been severely dented, along with Mr. Dimon’s vaunted prowess at sensing danger before the rest of Wall Street. Mr. Dimon has called the failed trade “sloppy” and “stupid.”

The appearance by Mr. Dimon at the Deutsche Bank conference was his latest in a campaign of contrition. He has offered apologies everywhere, from NBC’s “Meet the Press” on May 13 to the annual shareholder meeting in Tampa, Fla., last week.

“We try to do everything by the book,” he said Monday, after being asked why the bank went public so quickly with news of the trading loss, beginning with a hastily arranged conference call Mr. Dimon had with analysts on May 10.

“You’re allowed to be wrong,” he added. “But to be that wrong, that quickly, we felt terrible.”

Is JP Morgan CEO Jamie Dimon the "Tempest in the Teapot?"

( I think JPMorgan needs a new financial statistical model. Don't worry, you just draw lines that go up, and make them colorful, so you can make yourself look really good, I've actually seen this done before...don't worry I'm sure everything will be fine. :) LOVE YOU)

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

SEC JPMorgan Chase Investigation: Agency Looking At 'Appropriateness And Completeness' Of Financial Reporting

Reuters | Posted: 05/22/2012 10:36 am Updated: 05/22/2012 11:15 am

WASHINGTON, May 22 (Reuters) - The U.S. Securities and Exchange Commission will look into the "appropriateness and completeness" of JPMorgan Chase & Co's financial reporting following the bank's recent disclosure of large trading losses, SEC Chairman Mary Schapiro told the Senate Banking Committee on Tuesday.

Earlier this month JPMorgan announced it had suffered at least $2 billion in losses, a figure that is expected to grow, after a series of trades that the bank says were intended to hedge risk went awry.

Monday, May 21, 2012

Do I hear 2billion, Nope How About 5,6, MAYBE 7Billion??

(My personal opinion on this is simple: It is quite possible that there wasn't enough "Power" to get attention when the so called 99% were peacefully trying to get JPMorgan to be held accountable, let's see how long it takes for the 1% to get brutally angry at the 1% and lets see if the stockholders that have lost their shorts or worse... can get a handle on the "creative finances" of the wonder that is Chase. Gosh, with the SEC, FBI, Congress, and Jamie Dimon...we might have to hold out for the longest staring contest of all time. What a BLUNDER, Hey, speaking of which, Mr. Dimon, I know that you have a jam packed week, what with meeting with the Senate Banking Commission and all, but would love for you to call me so I don't have to be stuck in this limbo....its kindof like your limbo though....I can only imagine, you know where everything is just out there....and there are wolves at the door, and everything hangs in the balance, and clowns are running the show. That must be inconvenient. I know the feeling though...so, lets make this right, give me a call, at the very least this little pesky problem of JPMorgan committing foreclosure fraud could use a little positive publicity, right? Whatda Say? Wanna make a deal? :) LOVE YOU xoxooxoxoxoxooxoxoxoxo

An overall drop in the market is exacerbating JPMorgan's losses tied to its bets on corporate bonds.

NEW YORK (CNNMoney) -- One thing seems clear about JPMorgan Chase's $2 billion loss. It's no longer $2 billion. It's likely much higher.

An overall drop in the market is exacerbating JPMorgan's losses tied to its bets on corporate bonds.

NEW YORK (CNNMoney) -- One thing seems clear about JPMorgan Chase's $2 billion loss. It's no longer $2 billion. It's likely much higher.

The number being bandied about now is closer to a range of $6 billion to $7 billion, according to several people working on trading desks that specialize in the derivatives JPMorgan Chase (JPM, Fortune 500) used to make its trades and from two sources with knowledge of the bank's positions.

JPMorgan Chase declined to comment on its trading activities. Of course, it is impossible to know with absolute certainty just how high the losses are at any given moment.

But experts said there are few scenarios in which hedge funds on the other side of the bank's giant bet will let JPMorgan Chase out of it without significantly more pain.

"The market knows roughly what [JPMorgan] has and what the sizes are," said a source with knowledge of the bank's positions.

Why have the losses grown since chief executive officer Jamie Dimon informed the public of them? The market's overall slide hasn't helped.

Since last Thursday, the U.S. and European stock markets have dropped significantly. The S&P 500 (SPX) is down roughly 3.5%, and the main European indexes are down between 4% and 6%.

JPMorgan Chase's trades were built around contracts tied to corporate bonds. Specifically, JPMorgan Chase sold huge amounts of protection on an index of 125 highly rated corporate bonds. Simply put, JPMorgan Chase's massive trade stood a better chance to pay off if the market had continued to rally.

Now as the overall market has worsened, it costs even more for JPMorgan Chase to sell protection against possible bankruptcies on corporate bonds.

Since JPMorgan Chase is basically the only one on its side of the bet, a worsening market makes it even more expensive to keep this position and more difficult to find other places to offset these losses.

JPMorgan Chase's main bet has been on an index, known as IG9, of 125 U.S. investment grade companies. Shares of three of the 125 companies -- retailer J.C. Penney (JCP, Fortune 500) and insurers MBIA (MBI) and Radian (RDN) -- have taken big hits since last week, driving up the cost of offering protection against a default.

Additionally, since Dimon's announcement, more hedge funds have piled into the index, further driving up the cost of selling protection.

It's clear from public data filed with The Depository Trust & Clearing Corporation that JPMorgan Chase hasn't sold any of its positions yet. The DTCC tracks trading activity and sizes of positions on the IG9 and other indexes, and there haven't been any big moves since last week.

"Whatever the size was, it's clearly not something that you can call one or two dealers and sell," said Garth Friesen, a co-chief investment officer at AVM, a derivatives hedge fund that's not involved in these trades.

As soon as it becomes clear that JPMorgan Chase is unwinding its position, it will be obvious to players on every major trading desk. Hedge funds will immediately start piling into that index and buying protection, driving up the bank's losses.

Until then, it won't cost the hedge funds much to sit and wait.

"There will be a stare-fest between the hedge funds and JPMorgan," said James Rickards, former general counsel at Long-Term Capital Management, a hedge fund that required a $3.6 billion bailout from the Federal Reserve because of its massive losses from its trading activities.

"It will cost JPMorgan an unimaginable fortune to push the spread back in their direction," he added.

But JPMorgan Chase may blink first. It could face pressure from U.S. government regulators to start selling some of its positions.

Both the Securities and Exchange Commission and the Federal Bureau of Investigation are looking into JPMorgan's trade. Dimon has also been called to testify before the Senate Banking Committee.

The bank's shareholders may grow increasingly anxious as well, which could force JPMorgan Chase's hand. Shares are down 18% nearly since the company announced the loss.

"It's not just a battle between Dimon and the hedge funds," said Rickards. "It's been JPMorgan and the regulators, the FBI, Congressional committees and stock holders. It's not clear that their tolerance for pain will be as high as Jamie Dimon."

For now, the one thing working in JPMorgan Chase's favor is the market's bet that the bank is too big too fail, making it dangerous to push too hard on the other side of its trade.

But the dangers are far greater for JPMorgan Chase.

"Part of the problem of what they were doing is that they were too big in the trade to ever be able to trade out of it," said Friesen, who is also a member of the Federal Reserve Bank of New York's advisory group

JPMorgan Chase loss only going to get worse

By Maureen Farrell @CNNMoneyInvest May 20, 2012: 8:50 PM ET An overall drop in the market is exacerbating JPMorgan's losses tied to its bets on corporate bonds.

An overall drop in the market is exacerbating JPMorgan's losses tied to its bets on corporate bonds.The number being bandied about now is closer to a range of $6 billion to $7 billion, according to several people working on trading desks that specialize in the derivatives JPMorgan Chase (JPM, Fortune 500) used to make its trades and from two sources with knowledge of the bank's positions.

JPMorgan Chase declined to comment on its trading activities. Of course, it is impossible to know with absolute certainty just how high the losses are at any given moment.

But experts said there are few scenarios in which hedge funds on the other side of the bank's giant bet will let JPMorgan Chase out of it without significantly more pain.

"The market knows roughly what [JPMorgan] has and what the sizes are," said a source with knowledge of the bank's positions.

Why have the losses grown since chief executive officer Jamie Dimon informed the public of them? The market's overall slide hasn't helped.

Since last Thursday, the U.S. and European stock markets have dropped significantly. The S&P 500 (SPX) is down roughly 3.5%, and the main European indexes are down between 4% and 6%.

JPMorgan Chase's trades were built around contracts tied to corporate bonds. Specifically, JPMorgan Chase sold huge amounts of protection on an index of 125 highly rated corporate bonds. Simply put, JPMorgan Chase's massive trade stood a better chance to pay off if the market had continued to rally.

Now as the overall market has worsened, it costs even more for JPMorgan Chase to sell protection against possible bankruptcies on corporate bonds.

Since JPMorgan Chase is basically the only one on its side of the bet, a worsening market makes it even more expensive to keep this position and more difficult to find other places to offset these losses.

JPMorgan Chase's main bet has been on an index, known as IG9, of 125 U.S. investment grade companies. Shares of three of the 125 companies -- retailer J.C. Penney (JCP, Fortune 500) and insurers MBIA (MBI) and Radian (RDN) -- have taken big hits since last week, driving up the cost of offering protection against a default.

Additionally, since Dimon's announcement, more hedge funds have piled into the index, further driving up the cost of selling protection.

It's clear from public data filed with The Depository Trust & Clearing Corporation that JPMorgan Chase hasn't sold any of its positions yet. The DTCC tracks trading activity and sizes of positions on the IG9 and other indexes, and there haven't been any big moves since last week.

"Whatever the size was, it's clearly not something that you can call one or two dealers and sell," said Garth Friesen, a co-chief investment officer at AVM, a derivatives hedge fund that's not involved in these trades.

As soon as it becomes clear that JPMorgan Chase is unwinding its position, it will be obvious to players on every major trading desk. Hedge funds will immediately start piling into that index and buying protection, driving up the bank's losses.

Until then, it won't cost the hedge funds much to sit and wait.

"There will be a stare-fest between the hedge funds and JPMorgan," said James Rickards, former general counsel at Long-Term Capital Management, a hedge fund that required a $3.6 billion bailout from the Federal Reserve because of its massive losses from its trading activities.

"It will cost JPMorgan an unimaginable fortune to push the spread back in their direction," he added.

But JPMorgan Chase may blink first. It could face pressure from U.S. government regulators to start selling some of its positions.

Both the Securities and Exchange Commission and the Federal Bureau of Investigation are looking into JPMorgan's trade. Dimon has also been called to testify before the Senate Banking Committee.

The bank's shareholders may grow increasingly anxious as well, which could force JPMorgan Chase's hand. Shares are down 18% nearly since the company announced the loss.

"It's not just a battle between Dimon and the hedge funds," said Rickards. "It's been JPMorgan and the regulators, the FBI, Congressional committees and stock holders. It's not clear that their tolerance for pain will be as high as Jamie Dimon."

For now, the one thing working in JPMorgan Chase's favor is the market's bet that the bank is too big too fail, making it dangerous to push too hard on the other side of its trade.

But the dangers are far greater for JPMorgan Chase.

"Part of the problem of what they were doing is that they were too big in the trade to ever be able to trade out of it," said Friesen, who is also a member of the Federal Reserve Bank of New York's advisory group

Sunday, May 20, 2012

JPMorgan Chase CEO Jamie Dimon says "LET THE DUMB BANKS FAIL"

Let the banks fail, and the world will be fine. Really? "Let the dumb banks fail"

Really??? Gosh, after watching this video, I just feel sick, seriously. To hear Jamie Dimon saying words like,

reform, rational, resolution, and talking about "dumb banks" I find this all very interesting and special.

So, have you planned for risk....have you pulled my file yet?? Now, I know that I'm the least of your problems, you settled over $10million in suits this past quarter and now you have this whole $3billion calamity to deal with, but I'm patient...really, really, patient. Thank you for sending your people to leave me more love letters this week though, I appreciate that taunting little letters suggesting that you would talk to me, but so glad that I could help someone keep their $10.00 an hour job putting notices on doors. Imagine their surprise when I say, "have Jamie Dimon call me" and they say, "who is Jamie Dimon?" I just laugh.

So, I'm still here...praying really hard for you. :) I LOVE YOU. Yes, this is personal...

Really??? Gosh, after watching this video, I just feel sick, seriously. To hear Jamie Dimon saying words like,

reform, rational, resolution, and talking about "dumb banks" I find this all very interesting and special.

So, have you planned for risk....have you pulled my file yet?? Now, I know that I'm the least of your problems, you settled over $10million in suits this past quarter and now you have this whole $3billion calamity to deal with, but I'm patient...really, really, patient. Thank you for sending your people to leave me more love letters this week though, I appreciate that taunting little letters suggesting that you would talk to me, but so glad that I could help someone keep their $10.00 an hour job putting notices on doors. Imagine their surprise when I say, "have Jamie Dimon call me" and they say, "who is Jamie Dimon?" I just laugh.

So, I'm still here...praying really hard for you. :) I LOVE YOU. Yes, this is personal...

Hedge Your Bets, do I hear $2BILLION, NOPE How about $3 Billion!!!!

Saturday, May 12, 2012

AP: Calls to toughen regulation follow JPMorgan loss

WASHINGTON (AP) — JPMorgan Chase faced intense criticism Friday for

claiming that a surprise $2 billion loss by one of its trading groups

was the result of a sloppy but well-intentioned strategy to manage

financial risk.

More than three years after the financial industry almost collapsed, the

colossal misfire was cited as proof that big banks still do not

understand the threats posed by their own speculation.

"It just shows they can't manage risk — and if JPMorgan can't, no one

can," said Simon Johnson, the former chief economist for the

International Monetary Fund.

JPMorgan is the largest bank in the United States and was the only major

bank to remain profitable during the 2008 financial crisis. That lent

credibility to its tough-talking CEO, Jamie Dimon, as he opposed

stricter regulation in the aftermath.

But Dimon's contention that the $2 billion loss came from a hedging

strategy that backfired, not an opportunistic bet with the bank's own

money, faced doubt on Friday, if not outright ridicule.

"This is not a hedge," said Sen. Carl Levin, D-Mich., chair of a

subcommittee that investigated the crisis. He said the trades were

instead a "major bet" on the direction of the economy, as published

reports suggested.

On Friday, Dimon told NBC News, for an interview airing Sunday on "Meet

the Press," that he did not know whether JPMorgan had broken any laws or

regulatory rules. He said the bank was "totally open" to regulators.

|

| oh, sorry not the $200 billion...it's actually $300billion. opsie...looks like they didn't have enough time to get those documents fixed. |

The head of the Securities and Exchange Commission, Mary Schapiro, told

reporters that the agency was focused on the JPMorgan loss but declined

to comment further.

JPMorgan's disclosure Thursday recharged a debate about how to ensure

that banks are strong and competitive without allowing them to become so

big and complex that they threaten the financial system when they

falter.

The JPMorgan loss did not cause anything close to the panic that

followed the September 2008 failure of the Lehman Brothers investment

bank. But it shook the confidence of the financial industry.

Within minutes after trading began on Wall Street, JPMorgan stock had

lost almost 10 percent, wiping out about $15 billion in market value. It

closed down 9.3 percent.

Fitch Ratings downgraded the bank's credit rating by one notch, while

Standard & Poor's cut its outlook JPMorgan to "negative," indicating

a credit-rating downgrade could follow.

Morgan Stanley and Citigroup closed down more than 4 percent, and

Goldman Sachs closed down almost 4 percent. The broader stock market was

down only slightly for the day.

Dimon gave few details about the trades Thursday beyond saying they

involved "synthetic credit positions," a type of the complex financial

instruments known as derivatives.

Enhanced oversight of derivatives was a pillar of the 2010 financial

overhaul law, known as Dodd-Frank, but the implementation has been

delayed repeatedly and will not take effect until the end of this year

at the earliest.

JPMorgan's trades show that the derivatives market remains too opaque

for regulators to oversee effectively, said Rep. Barney Frank, D-Mass.,

one of the law's namesakes.

"When a supposedly responsible, well-run organization could make such an

enormous mistake with derivatives, that really blows up the argument,

'Oh, leave us alone, we don't need you to regulate us,'" he said.

Criticism of the bank did not stop with its traditional chorus of

detractors. It also came from Sen. Bob Corker, R-Tenn., a prominent

member of the Senate Banking Committee who has received $10,000 since

January 2011 from JPMorgan's political action committee, the most any

candidate has received.

Corker, a leader of a failed effort last year to block a Federal Reserve

rule that slashed bank profits from debit cards, called for a hearing

"as expeditiously as possible" into the events surrounding JPMorgan's

loss.

Tim Ryan, president of the Securities Industry and Financial Markets

Association, a trade group, said it was impossible to legislate or

regulate risk out of the financial system.

"My hope is that this is viewed as bona fide hedging, but it went

wrong," he said in an interview. "A mistake was made. Money is going to

be lost. It's not customer money. It's not government money. It's

JPMorgan's money, the shareholders of JPMorgan."

No one seemed to suggest Friday that JPMorgan had broken a law. But the

mistake added a wrinkle to the still-unsettled discussion about how the

financial industry should be regulated in the aftermath of 2008.

"This just tells you that we are a long, long way from getting our arms

around this whole 'too big to fail' issue," said Cliff Rossi, a former

top risk executive for Citigroup, Countrywide and other big financial

companies.

Immediately after the crisis, a time of popular outrage over bailouts

and investment losses, there was broad public support for an overhaul of

bank regulations.

The changes promoted by the Obama administration were in many cases

similar to what the financial industry had sought before the crisis:

Consolidation of regulators and oversight of the multi-trillion-dollar

marketplace for derivatives.

Regulators are still drafting hundreds of rules under the 2010 law. As

Wall Street has returned to record profits, and executives to

million-dollar bonuses, banks have fought to soften those rules.

In particular, the industry has fought hard against a few provisions that might have prevented the problems at JPMorgan.

One is the so-called Volcker rule, which will prohibit banks from

trading for their own profit. The rule is still being written, and the

Federal Reserve has said it will begin enforcement in 2014.

JPMorgan said that its bets were made only to hedge against financial

risk. Dimon conceded that the strategy was "egregious" and poorly

monitored. But analysts, former bank executives and many lawmakers

disagreed.

"This is an exact description of proprietary trading-style activity,"

Sen. Jeff Merkley, D-Ore., told reporters Friday. "This really is a

textbook illustration of why we need a strong Volcker rule firewall."

Nancy Bush, a longtime bank analyst at NAB Research and a contributing

editor at SNL Financial, said the trades probably crossed that line

because they were making money for JPMorgan.

"So they made money on hedges and then they hedged some more," she said.

"At some point it goes from being a hedge to being a moneymaker."

JPMorgan was seen as a savior of weaker banks during the financial

crisis and the only big bank to escape relatively unscathed. His

reputation enhanced, Dimon, 56, has been emboldened to challenge efforts

to toughen regulation.

In an interview with the Fox Business Network earlier this year, Dimon

said that Paul Volcker, the former Federal Reserve chairman for whom the

rule is named "doesn't understand capital markets."

Last year, he questioned the current Fed chair, Ben Bernanke, about the

rules and said they might be delaying the recovering of the financial

system and the broader economy.

"Has anyone bothered to study the cumulative effect of all these things?" he asked.

Dimon, who grew up in the Queens borough of New York and was groomed by

the former Citigroup chief executive Sanford Weill, has also chafed

against Occupy Wall Street protesters.

"Acting like everyone who's been successful is bad and that everyone who

is rich is bad — I just don't get it," he said at a conference earlier

this year.

On Thursday, at about the same time he was breaking news of the $2

billion loss to Wall Street, Dimon sent an email to JPMorgan's 270,000

worldwide employees assuring them that the company was "very strong."

___

AP Business Writer Marcy Gordon, AP Business Writer Pallavi Gogoi and

Associated Press writer Jack Gillum contributed to this report.

Daniel Wagner can be reached at www.twitter.com/wagnerreports.

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

(I added the pictures to this story by writer Marcy Gordon, AP Business Writer Pallavi Gogoi and

Associated Press writer Jack Gillum contributed to this report.) I think it adds a little more light to all of this maddness. Oh, which reminds me....it is only a matter of time when the CEO sends out 240,000 emails assuring his employees that everything is fine...for them to realize that it's all smoke and mirrors.)

The greatest con ever pulled is when the con actually gets you to believe what they say. It's only a con if you let them, you are only then conned if you don't challenge them...CHALLENGE THEM.

So, JAMIE DIMON, I challenge you again, to pick up the phone and call me, because your employees won't talk to me, meanwhile I don't appreciate attempted extortion, so lets talk. Call me, xooxoxox -Michelle

Friday, May 18, 2012

Top CEOs SENT TO PRISON: I WONDER WHO WILL BE NEXT? LOVE YOU CHASE, SO MUCH

Top CEOs Sent to Prison

Earlier this week, Rebekah Brooks, former CEO of the now-defunct British tabloid News of the World, was arrested on conspiracy to pervert the court of justice. The case against Brooks and the phone hacking scandal is an exception to the usual story of CEOs that end up in prison. Most of their corporate wrongdoings generally involve corruption, insider trading and fraud. Given the difference, 24/7 Wall St. identified the top CEOs that went to prison.The kinds of crimes these executives commit generally fall into one of two categories. In the first case, CEOs mean to profit directly from their actions, including offenses such as insider trading and embezzlement. Examples of this include Tyco’s CEO Dennis Kozlowski and Adelphia’s CEO Jonathan Rigas, who each stole millions of dollars from their companies.

The irony is that while these corporate leaders were trying to make their companies look better, they usually succeeded only in putting them through a period of severe financial hardship, as was the case with Rite Aid. In several cases, such as Adelphia and Enron, the financial revelations were so severe, causing total bankruptcy. In a few cases, Tyco for example, the company continued to perform well, despite the crimes.

24/7 Wall St. examined the CEOs who have been arrested while heading Fortune 500 corporations.

(AP Photo/Sang Tan)

5. Bernard “Bernie” Ebbers

Company: WorldComCurrent status of the company: Bankrupt and acquired

The fall of Bernard “Bernie” Ebbers, former CEO of WorldCom, began once the telecommunication company’s proposed merger with Sprint (NYSE: S) fell through in June 2000 due to antitrust laws. WorldCom’s stock subsequently plummeted and Ebbers and his executive team continued to rearrange the books to the tune of $11 billion in a desperate attempt to cover up losses. In 2002, the fraud was discovered by internal auditors and Ebbers ousted. In March 2005, Ebbers was convicted of conspiracy, securities fraud and seven counts of filing false reports with regulators. He’s currently serving a 25-year sentence in a Louisiana jail.

4. Richard Scrushy

Company: HealthSouthCurrent status of the company: Still active

Richard Scrushy, former CEO of HealthSouth (NYSE: HLS), has 20 years of illicit practices to his credit. Scrushy authorized the firing of whistle blowers, bribed and threatened HealthSouth execs and was complicit in illegal accounting practices. In November, 2003, Scrushy was indicted on charges of conspiracy, securities fraud, money laundering and mail fraud. However, the slippery Scrushy was acquitted on all charges in June, 2005. Less than four months later, he was indicted once again, this time on 30 counts of extortion, obstruction of justice, money laundering, racketeering and bribery. In June, 2007, Scrushy was finally sentenced to six years and 10 months in prison.

3. Walter Forbes

Company: CendantCurrent status of the company: Split up

In 1998, Hospitality Franchise Systems, a platform used to purchase hotel chains, merged with direct marketing company Comp-U-Card International to form Cendant. The new corporation soon discovered, however, that Walter Forbes, CUC’s former CEO and the CEO of the newly formed Cendant, had grossly misrepresented the financial status of CUC. He reported at least $500 million in nonexistent profits. Forbes, who insisted he knew nothing about the situation, was forced out. By 2002, the ex-CEO was indicted under fraud charges, and in 2007, after years of appeals, he was sentenced to 12 years in prison and $3.28 billion in damages. In 2005, Cendant split up and spun off into several different companies.

2. Joseph Nacchio

Company: QwestCurrent status of the company: Acquired

In March, 2005, telecommunication company Qwest’s CEO Joseph Nacchio and several executives were indicted by the SEC. The charges included inflating revenue estimates, lying about nonexistent forthcoming government contracts, and illegally profiting from the run-up in the stock price. In 2007, Nacchio was sentenced to six years in prison. He was also ordered to pay a $19 million fine and forfeit an additional $52 million he had made through illegal trading. Nacchio appealed several times, losing his final appeal in the U.S. Court of Appeals for the Tenth Circuit. He began serving his term in February, 2009, but even now his legal team is petitioning to be heard in the Supreme Court.

1. Martin L. Grass

Company: Rite-AidCurrent status of the company: Still active

In 1999, Rite-Aid (NYSE: RAD) CEO Martin L. Grass, the son of company founder Alex Grass, was forced to resign from the post he had held for just four years. Grass was formally indicted in 2002, along with several other high-ranking executives at the drugstore chain, for conspiracy to defraud, making false statements, as well as accounting fraud. In 2004, Grass pleaded guilty and reached a plea agreement to serve at least eight years in prison and pay a $500,000 fine, as well as waive $3 million in owed salary. In 2009, Grass moved into a halfway house and was subsequently released in 2010.

88888888888888888888888888888888888888888888888888888888888888888

Wednesday, May 16, 2012

NPR "Is JPMorgan Chase Too Big To Manage?" My answer...YES.

You ever hear that saying, Pigs get fat, but Hogs Get Slaughtered? Have we had enough of this nonsense yet?? I wanted to share this NPR story with you...this all just makes me shake my head...meanwhile, NO WORD...just the run around...the saga continues.

********************************

Is JPMorgan Chase Too Big To Manage?

JP Morgan Chase has long had the reputation of

being one of the better managed big banks in the country. So how did it

make a $2 billion blunder? To find out, David Greene talks to David

Wessel, economics editor of The Wall Street Journal.

Copyright

© 2012 National Public Radio®. For personal, noncommercial use only.

STEVE INSKEEP, HOST:It's MORNING EDITION from NPR News. Good morning. I'm Steve Inskeep.

DAVID GREENE, HOST:

And I'm David Greene.

JP Morgan Chase has long had the reputation of being one of the better managed big banks in the country. So how did it make a $2 billion blunder and what does it tell us about banking today, nearly five years after the onset of the financial crisis? When such questions are looming, we often turn to David Wessel, economics editor of The Wall Street Journal.

And, David, welcome back to the program.

DAVID WESSEL: Good morning.

GREENE: Well, let's start with what I suppose is seemingly a basic question. What exactly was JP Morgan trying to do with this financial maneuver that went wrong?

WESSEL: Well, that's something that the bank's chief executive Jamie Dimon has been trying to explain. He did it on "Meet the Press" on Sunday and he surely will try again today when they have the company's annual shareholder meeting in Tampa, Florida.

As he tells it, JP Morgan Chase is in the business of making loans and investing in securities, buying corporate bonds. To reduce their risks, it hedges. And hedges means you kind of take out insurance in case your borrowers don't pay back their loans. And in this case they took out insurance. They thought they took out too much insurance, so they tried to offset that by selling some insurance. That's what they were trying to do.

Now, why would a bank do this? Well, Mr. Dimon and other bankers say that in order to manage the risk of their portfolio, in order to make their business less risky, they do this hedging and that allows them to make more loans - more care loans, more credit card loans, more job-creating business loans and stuff like that. Unfortunately, it didn't work out as they'd planned.

GREENE: I mean, this seems pretty astounding. You keep using terms like hedge and reduce risk. And they're basically arguing that an effort to reduce risk loses $2 billion. I mean, is everyone buying this explanation?

WESSEL: No, and especially from the outside, it's incredibly hard to tell the difference between a hedge where you're offsetting some risks you take in your business and simply going to the casino and making bet in the hopes of making a profit.

And there are a lot of people outside JP Morgan who said, look, that's what they were doing. In fact, some people who used to work at JP Morgan have been saying that's what they were doing. Yes, they were running a little insurance business to protect their banking business, but on the side they were trying to make what they call icing, some profits on the side.

And the critics of current banking practices say, look, if people want to hedge, if they want to go and speculate in the market, that's fine. But the people who do that shouldn't be in the business of running a bank that has government guaranteed deposits. You shouldn't mess up these two businesses.

GREENE: Even bringing up the word casino as a comparison for a bank is probably something no one ever wants to hear.

WESSEL: Right, especially Jamie Dimon.

GREENE: Well, can you just give us a window into a sophisticated bank like this? I mean, you have this image of a place with very smart experts and all these, you know, safety precautions in place. How could this happen?

WESSEL: Well, that's what's so scary here. So as you said at the beginning, JP Morgan Chase was supposed to be one of the best managed banks. They got through the financial crisis largely unharmed. And they managed to make a deal that was so complicated that its own senior management couldn't really understand it.

Now, Mr. Dimon says we're still going to earn a lot of money this quarter. So it isn't like the bank is jeopardized. And that, as far as we know, is true. But it did take 10 percent off its stock price. And it is raising the question about whether this bank and its peers are simply too big to manage. After all, if Jamie Dimon can't figure out what his London investment office is doing, who can?

We worried a lot about banks during the crisis that we called too big to fail. That is the government couldn't let them go under and had to bail them out. But the result has been that banks are even bigger than they were before the crisis. And this too big to manage theme is really, really front and center now.

GREENE: And, David Wessel, really briefly - I mean, people who don't own, you know, stock in JP Morgan, I mean, you know, Americans out there, should they be worried about this, you know, becoming a larger problem?

WESSEL: Yes. One, it's a big mistake and taxpayers pay if it gets to be a bigger mistake. So the question is, is this is a warning sign that banks are back to their old shenanigans. And secondly, what happens at one bank usually doesn't happen only at one bank. All bank stocks are down on this. And the question is whether banks are doing things that will go kablooey(ph) and put he economy at risk the way it was four or five years ago.

GREENE: All right. David, thanks so much.

WESSEL: You're welcome.

GREENE: David Wessel is economics editor of the Wall Street Journal.

Copyright

© 2012 National Public Radio®. All rights reserved. No quotes from the

materials contained herein may be used in any media without attribution

to National Public Radio. This transcript is provided for personal,

noncommercial use only, pursuant to our Terms of Use. Any other use

requires NPR's prior permission. Visit our permissions page for further

information.

NPR

transcripts are created on a rush deadline by a contractor for NPR, and

accuracy and availability may vary. This text may not be in its final

form and may be updated or revised in the future. Please be aware that

the authoritative record of NPR's programming is the audio.

Monday, May 14, 2012

S.E.C. Investigating JPMorgan's $2Billion Loss, Hope they Can Follow the Money.

****I'm reminded of the SEC calamity during the Bernie Madoff ripoff...I'm curious to see if the are more competent in their investigations now, I have a sneaking suspicion that once they are brought information they investigate that now!! Only time will tell though...time, time, time....

May 11, 2012, 12:47 pmLegal/Regulatory

S.E.C. Opens Investigation Into JPMorgan’s $2 Billion Loss

By BEN PROTESS and SUSANNE CRAIG

Regulators

are investigating potential civil violations surrounding the $2 billion

loss that JPMorgan Chase disclosed on Thursday, raising further

questions about trading activities at the nation’s biggest bank.

The Securities and Exchange Commission recently opened a preliminary investigation into JPMorgan’s accounting practices and public disclosures about the trades, according to people briefed on the matter, who spoke on the condition of anonymity because the case is not public. Regulators learned about the activities in April, and formally opened an investigation in recent days, the people said.

The inquiry, which is being run out of New York, will probably examine the bank’s past regulatory filings about the internal unit that placed the trades, as well as recent statements from the firm’s top executives.

In April, questions surfaced about the group, called the chief investment office, after reports emerged that a London-based trader was taking large bets that distorted the market. At the time, Jamie Dimon, the bank’s chief executive, publicly dismissed the concerns about the trading activities, calling them a “complete tempest in a teapot.”

On Thursday, JPMorgan revealed that the group had suffered significant losses, which could cost the firm $2 billion or more. A more humble Mr. Dimon on Thursday said “egregious mistakes” were made.

An important avenue for the S.E.C. investigation, the people said, is the firm’s accounting methods relating to the trades. Investigators could take a close look at a measure known as value-at-risk. The company disclosed earlier this year that it changed the way it calculates the metric, which may have masked some of the risk surrounding this trade. On a conference call Thursday, Mr. Dimon said the firm had reverted to the old way of measuring value-at-risk.

The people cautioned that the investigation is at an early stage. No one at JPMorgan has been accused of any wrongdoing. JPMorgan was not immediately available for comment. A spokesman for the S.E.C. declined to comment.

The $2 billion trading loss comes as policy makers put the finishing touches on new industry regulations, including the so-called Volcker Rule that bans banks from making bets with their own money. Banks, including JPMorgan, have been pushing back on some of the rules, saying they will hurt the markets and the broader economy. But JPMorgan’s disclosure on Thursday could provide bank reformers with additional fodder.

“The enormous loss JPMorgan announced today is just the latest evidence that what banks call ‘hedges’ are often risky bets that so-called ‘too big to fail’ banks have no business making,” Senator Carl Levin, a Michigan Democrat, said in a statement on Thursday.

United States and British regulators have been taking a look at the JPMorgan unit for nearly a month, after media reports shined a spotlight on the trading group. The bank started talking with the Federal Reserve and Britain’s Financial Services Authority about the chief investment office in April, according to people with direct knowledge of the matter. The S.E.C. became aware of the group’s activities around the same time.

In the weeks that followed, regulators asked for more information about the unit’s activities. When the losses started to mount, JPMorgan informed regulators in the week prior to Thursday’s official announcement, one of the people said.

“It’s not surprising that we’ve been holding discussions about what has been going on,” said one person, who spoke on condition of anonymity.

Mark Scott contributed reporting from London.

The Securities and Exchange Commission recently opened a preliminary investigation into JPMorgan’s accounting practices and public disclosures about the trades, according to people briefed on the matter, who spoke on the condition of anonymity because the case is not public. Regulators learned about the activities in April, and formally opened an investigation in recent days, the people said.

The inquiry, which is being run out of New York, will probably examine the bank’s past regulatory filings about the internal unit that placed the trades, as well as recent statements from the firm’s top executives.

In April, questions surfaced about the group, called the chief investment office, after reports emerged that a London-based trader was taking large bets that distorted the market. At the time, Jamie Dimon, the bank’s chief executive, publicly dismissed the concerns about the trading activities, calling them a “complete tempest in a teapot.”

On Thursday, JPMorgan revealed that the group had suffered significant losses, which could cost the firm $2 billion or more. A more humble Mr. Dimon on Thursday said “egregious mistakes” were made.